1Department of Financial Administration, School of Management, Central University of Punjab, Bathinda, Punjab, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

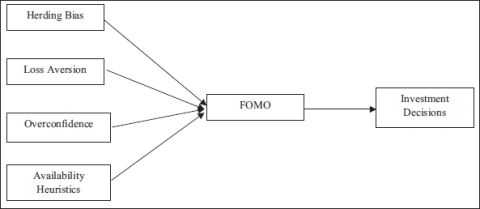

The continuous digital revolution has changed the way investors conduct research, exchange ideas, and carry out investment plans. Simultaneously, social media platforms have become vibrant sources of real-time market sentiment research, crowdsourcing investment ideas, and financial news. The core objective of the study is to examine the connection between fear of missing out (FOMO) and significant behavioral biases, including herd mentality, overconfidence, loss aversion, and availability heuristics. A qualitative study methodology was used, including a literature assessment of previous studies on behavioral finance, FOMO, and investing decisions. FOMO is the term used to characterize generalized anxiety that is brought on by the idea of losing out on something that other people find enjoyable or have. The results show that FOMO has a major impact on investors by increasing their emotional responses to market developments. This leads them to make illogical choices, emphasizing short-term rewards above long-term financial security. By analyzing the body of prior research and expanding the theoretical understanding of the intellectual underpinnings and social structure of behavioral biases, this study offers unique insights for government, policymakers, brokerage firms, financial planners, and investors. This study highlights the need to address digital and social media behavioral biases, which significantly impact investment decisions in an interconnected world.

Herding bias, overconfidence, loss aversion, availability heuristics, FOMO, investment decision

Introduction

Background of the Study

In recent years, the way people engage with investment possibilities has changed due to the fast expansion of technology and the increasing accessibility of financial markets (Idris, 2024). Decisions about the same significantly influence a family’s ability to improve their quality of life and achieve financial contentment (Sahi et al., 2013). Barberis and Thaler (2003) demonstrated that since the family’s financial situation is impacted by the investment selections, investors are more worried about potential losses, which has been defined as loss aversion in the prospect theory. Financial consumers now have a wealth of options for where to spend their savings in the present investing market (Sahi, 2017). To optimize their economic well-being, investors are unprepared to assess all the options. As a result, the person is forced to use specific decision-making processes and is swayed by feelings and psychological factors while choosing an investment. Fama (1997) stated in terms of their investment returns and market anomalies, investors often overreact and underestimate it. Due to a variety of factors, including age, gender, ethnicity, degree of education, and social and economic background, each individual is unique. Their largest challenge is choosing what investments to make; other than that, they act normally and rationally. They should consider their emotional inclinations and gut instincts while making investment decisions.

The idea that people do not always act rationally when making financial decisions and may be influenced by irrational factors that have the potential to lead to emotional (irrational) investment preferences is known as behavioral finance, and it is defined as the “emotional” feelings experienced by investors when investing (Ferreira, 2017). Emotional finance, fueled by psychoanalytic processes in the human mind, is similar to behavioral finance in that it discusses how an individual’s unconscious needs, wants, and emotions influence their investing choices and, in general, how they affect the markets (Taffler, 2018). Studies on behavioral and emotional finance related to this topic often show that people’s socio-psychological traits and demographics influence their investing choices and need to be looked into appropriately (Statman, 2014). This issue is not exclusive to individual equities; investors who use mutual funds rather than individually purchasing stocks are also susceptible to similar biases while investing in the equity market.

Fear of Missing Out (FOMO)

FOMO is the emotional reaction to the belief that others are partaking in an event, opportunity, or reward from which one feels excluded. The feeling of isolation and the desire to avoid remorse may prompt people to behave impulsively, motivated by fear rather than logical reasoning (Idris, 2024). The increasing prevalence of digital platforms that facilitate instantaneous access to information and constant connectivity has coincided with the emergence of FOMO as a recognized psychological phenomenon. FOMO can also manifest when people make decisions solely because others are doing so, resulting in a lack of digital presence (Tandon et al., 2021). A concept that researchers have investigated in the context of cognitive bias is herding bias, which is quite similar. Herding behavior is the inclination of individuals to emulate the actions and decisions of a larger group, regardless of whether or not those actions and decisions are rational or logical (Ansari & Ansari, 2021). In financial markets, herding behavior may result in asset price bubbles and collapses, as investors emulate the actions of others without evaluating their own understanding of market circumstances (Naina & Gupta, 2022). FOMO has become a more pronounced problem, mostly fueled by digital advancements in financial services. Traditional behavioral biases like herd mentality, overconfidence, loss aversion, and availability heuristics have always impacted investor behavior, but contemporary technology has amplified these impacts (Idris, 2024). Social media platforms, online trading applications, and real-time market updates provide an incessant flow of information, often tailored to emphasize success narratives or market trends, intensifying a pervasive feeling of urgency and anxiety of lost chances. Gamified elements in trading platforms and the impact of financial influencers connect conventional biases with contemporary technology, making FOMO a dominant catalyst for impulsive and emotionally driven investing choices in the current digital era (Bomnüter et al., 2023).

Purpose of the Study

This study aims to examine the correlation between FOMO and significant behavioral biases—herd mentality, overconfidence, loss aversion, and availability heuristics—and to analyze how this psychological phenomenon influences the strategies and decision-making processes of investors. The research seeks to comprehend how FOMO mediates biases in investor behavior by analyzing theoretical frameworks, existing literature, and contemporary developments in digital trading platforms and social media impact, often resulting in illogical and emotionally driven market activities. This research aims to provide insights into the impact of FOMO-driven behavior on individual investment results and overall market dynamics by combining data from previous literature.

Literature Review

The phenomenon of FOMO has garnered considerable attention within behavioral finance, particularly regarding its influence on investing choices. Numerous research studies have examined the interaction between FOMO and various cognitive and emotional biases that impact investor behavior in diverse markets, especially in contexts driven by digital and social media. These studies highlight the growing prevalence of FOMO within volatile markets such as cryptocurrencies, stock trading, and the emergence of neo-broker platforms that are significantly intertwined with social media functionalities.

Friederich et al. (2024) investigate the influence of psychological variables, such as FOMO, on consumer participation in the Bitcoin market despite its intrinsic volatility and recurrent downturns. FOMO substantially influences investing choices, with emotional processes mitigating this impact and impulsivity serving as a moderator. The research indicates that FOMO appeals result in repeated investing choices despite previous losses, demonstrating the enduring nature of this psychological bias. Moreover, it is proposed that fear-based advertising may effectively mitigate the effects of FOMO, which has significant implications for scholars examining investor behavior and regulators aiming to oversee consumer participation in the cryptocurrency market.

Idris (2024) examines the influence of FOMO on overtrading, speculative investment, and the creation of asset bubbles within conventional stock markets. Their study highlights the emotional intensification induced by FOMO, resulting in illogical, short-term choices that favor instant rewards above long-term financial security. Proponents contend that social media and technology intensify the issue by promoting herd behavior and market instability, as shown by “meme stocks.” Young investors are particularly vulnerable to FOMO because of their dependence on social media for investing guidance, underscoring the need for financial literacy initiatives and regulatory measures to mitigate disinformation and the detrimental effects of FOMO-induced choices.

A significant topic of focus is the convergence of FOMO and gamification inside neo-broker platforms, which has emerged as a central theme in recent studies. Bomnüter et al. (2023) examine the impact of FOMO, in conjunction with the gamified elements of platforms such as Robinhood, on irrational investment behavior. Unlike other studies that examine them independently, this study mixes FOMO and gamification, highlighting their substantial influence on impulsive actions, especially among younger investors. The study indicates that social media-influenced neo-broker platforms exacerbate these impacts, resulting in emotionally driven investing choices. The research offers critical insights into the behavioral determinants of contemporary investment and underscores the impact of social media and gamification on financial decisions.

Research has also investigated the wider ramifications of FOMO on investor behavior in cryptocurrency markets. Kaur et al. (2023) examine the role of FOMO in mediating the interaction between biases such as herding, loss aversion, and overconfidence, particularly within the realm of cryptocurrency investing. FOMO significantly influences decision-making behavior, particularly in volatile markets such as cryptocurrency, where investors often make irrational decisions driven by the fear of missing possible rewards. This study corroborates the conclusions of Gupta and Shrivastava (2022), demonstrating that FOMO amplifies the influence of herding and loss aversion on retail investors’ decision-making. Their research indicates that FOMO mediates the connection between these biases, enhancing their impact on financial decisions and prompting irrational actions.

Shetty et al. (2023) and Gupta and Shrivastava (2022) investigate the impact of herding behavior and FOMO on investing choices in stock and retail markets. Their research underscores that FOMO, in conjunction with herd mentality, results in the creation of speculative bubbles and suboptimal investment decisions. This corresponds with the extensive studies into how behavioral biases such as loss aversion and herding influence market volatility and the emergence of bubbles. Shetty et al. (2023) underscore the significance of understanding the consequences of these biases to assist investors in making more prudent choices, hence fostering more sustainable investing practices.

The research emphasizes that information asymmetry intensifies the impact of FOMO on investment behavior. Güngör et al. (2022) examine how FOMO is often instigated by visual stimuli or media portrayals, although its effects may be alleviated when investors encounter credible financial facts. This study indicates that financial literacy and access to reliable information might mitigate the emotional impact of FOMO, resulting in more logical decision-making. Shiva et al. (2020) examine the impact of fear of missing out, in conjunction with information asymmetry, on investor behavior, especially in marketplaces characterized by unequal access to information. They contend that access to mobile devices and financial news via social media has introduced new hurdles for investors, exacerbating the risk of losing out on market opportunities and resulting in suboptimal financial decisions.

Kang et al. (2019) and Taffler (2018) examine the psychological foundations of FOMO, highlighting its impact on consumer behavior in both offline and online contexts. Their research indicates that FOMO is an influential factor in elucidating consumer uniformity and herd behavior, especially inside financial markets. The study highlights the role of unconscious emotional processes, including excitement, fear, and denial, in fostering irrational decision-making, a notion especially pertinent to the comprehension of asset price bubbles and the dynamics of financial crises. Taffler (2018) examines the influence of emotional drivers on asset management and asset price dynamics, highlighting the need to acknowledge unconscious mental processes in financial decision-making.

Finally, Riaz et al. (2012) examine the impact of risk perception, asymmetric information, and issue framing on investor behavior, especially on the phenomenon of FOMO. Their model demonstrates that investors’ judgments are influenced by both their risk tolerance and the presentation of information. The research underscores the significance of framing in influencing investing decisions and the impact of psychological biases on risk perception.

The evidence repeatedly indicates that FOMO is a substantial catalyst for irrational investing behavior, affecting decision-making in many financial environments. The interplay between FOMO and several cognitive biases, including herding, loss aversion, and overconfidence, intensifies its effects, especially in risky markets such as cryptocurrency and stock trading. Social media, gamification, and information asymmetry exacerbate the consequences of FOMO, resulting in impulsive and risky investing choices.

The existing literature clearly demonstrates that FOMO is a crucial psychological phenomenon that greatly influences investor behavior, especially within digitally driven financial environments. The interaction with classical behavioral biases—herding, overconfidence, loss aversion, and availability heuristics—often results in impulsive and irrational investment decisions (Friederich et al., 2024; Idris, 2024; Kaur et al., 2023). Research indicates that FOMO amplifies emotional trading and frequently leads to recurring investment errors. Additionally, some studies highlight the influence of gamified trading platforms such as Robinhood, where FOMO transcends a psychological trigger and becomes an intentional design element that increases impulsivity (Bomnüter et al., 2023). Further research identifies FOMO as a mediator between behavioral biases and decision outcomes, particularly in contexts of information asymmetry, media hype, and real-time digital influence (Gupta & Shrivastava, 2022; Shetty et al., 2023). Nonetheless, while recognizing the significant impact of FOMO, existing studies primarily concentrate on particular markets like cryptocurrency or meme stocks, fail to provide cohesive frameworks that connect various behavioral biases with FOMO, and present restricted empirical validation across a range of investor demographics and digital contexts.

Research Gap

While there is an increasing amount of research in behavioral finance, current studies often focus on individual biases like herding, overconfidence, loss aversion, and availability heuristics separately and how these biases interact in the context of FOMO. Recent advancements in digital platforms and social media have heightened investment behaviors driven by FOMO; however, there is a scarcity of studies providing a comprehensive framework that examines FOMO as a mediating factor among various behavioral biases. Furthermore, a significant portion of the research is predominantly theoretical, with insufficient empirical validation across various investor segments or technological contexts (Argan et al., 2023; Güngör et al., 2022; Gupta & Shrivastava, 2021). The identified gap prompted this study to explore FOMO in conjunction with significant behavioral biases—herding, overconfidence, loss aversion, and availability heuristics—to gain a deeper understanding of their collective influence on investment decisions within the contemporary digitally driven financial environment (Figure 1).

Discussion

Herding Bias, FOMO, and Investment Decisions

Herding bias and FOMO significantly shape investor behavior and market dynamics. Herding bias, as noted by Nofsinger and Sias (1999), reflects investors’ tendency to mimic others instead of making independent decisions, leading to a bandwagon effect (Dar & Hakeem, 2015). This behavior is exacerbated by FOMO, where investors fear missing out on potential gains that appear to be enjoyed by others. Gupta and Shrivastava (2022) highlight that this leads investors to follow market trends without adequate research, resulting in irrational choices. Historical examples, such as the dot-com bubble, the 2008 financial crisis, and the volatility surrounding meme stocks like GameStop, illustrate how herding and FOMO can create market instability, asset bubbles, and abrupt downturns (Shiller, 2000). In these scenarios, investors prioritized collective sentiment over individual analysis, leading to significant economic repercussions. But there are good things that may arise from FOMO as well. It may motivate investors to explore new opportunities and diversify their portfolios, especially in emerging markets or innovative sectors like technology and renewable energy (Baker et al., 2014). These positive outcomes indicate that FOMO, when combined with thorough research and a disciplined approach, can encourage informed risk-taking and foster engagement in growth opportunities.

Figure 1. Conceptual Framework.

Loss Aversion, FOMO, and Investment Decisions

Loss aversion and FOMO significantly influence investing behavior and market dynamics. Loss aversion, as described by Barberis and Thaler (2003), refers to investors’ tendency to avoid losses rather than pursue equivalent gains, with losses impacting emotions approximately 2.5 times more than gains. Noah et al. (2021) note that this leads investors to prioritize capital preservation, often resulting in premature asset sales or overly cautious decisions. The combination of FOMO, which drives the fear of missing out on market profits, further intensifies this behavior, causing investors to follow group trends and make poor choices to avoid losses from not participating in lucrative opportunities (Dar & Hakeem, 2015). During the 2008 financial crisis, loss aversion led many investors to sell shares at their lowest, locking in losses instead of waiting for recovery. Simultaneously, FOMO-driven speculative investments in subprime mortgage-backed securities contributed to the bubble's formation and collapse (Shiller, 2015). The cryptocurrency market has also exhibited similar patterns, with retail investors experiencing FOMO during bull runs, leading to risky investments in assets like Bitcoin, followed by panic selling during downturns (Gupta & Shrivastava, 2022). Nonetheless, FOMO may sometimes provide beneficial outcomes. It may inspire investors to investigate high-growth areas, such as technology or renewable energy, by instilling a feeling of urgency. Early investors in companies like Amazon and Tesla benefited from FOMO-driven decisions that were backed by thorough research and risk assessment (Baker et al., 2014). These examples suggest that when moderated by rational thinking, FOMO can lead to informed decision-making and long-term investment success.

Overconfidence, FOMO, and Investment Decisions

Overconfidence and FOMO significantly impact financial markets, shaping individual investing behaviors and broader market dynamics. As described by Hirshleifer (2015), overconfidence leads individuals to overestimate their knowledge and forecasting abilities, resulting in increased risk-taking. FOMO, driven by social influences and the fear of missing out on opportunities, often pushes investors toward short-term gains rather than long-term stability (Gupta & Shrivastava, 2022). These biases can distort rational decision-making, heighten market volatility, and contribute to financial instability (Dar & Hakeem, 2015). Historical examples illustrate the effects of these biases, such as during the late 1990s dot-com bubble, where overconfidence led investors to overvalue tech companies. At the same time, FOMO spurred herd behavior, resulting in a market crash (Shiller, 2015). Similarly, the GameStop incident in early 2021 showcased how retail investors’ overconfidence, amplified by FOMO and social media, caused significant price fluctuations and highlighted the risks of herd-driven markets (Kim et al., 2023). However, FOMO can also have positive effects, motivating investors to pursue high-growth opportunities, as seen with early adopters of renewable energy stocks and cryptocurrencies (Baker et al., 2014). Additionally, it may encourage individuals to seek financial advice, conduct research, or diversify investments to avoid missing out on potential profits.

Availability Heuristics, FOMO, and Investment Decisions

Availability heuristics and FOMO significantly impact financial decision-making and market dynamics. Availability heuristics, as defined by Ising (2007), refer to the cognitive bias where individuals rely on readily accessible information, often neglecting a comprehensive analysis of relevant facts. This bias can lead to FOMO, where consumers make financial decisions based on superficial information suggesting profitable opportunities. Güngör et al. (2022) note that this interplay can intensify herd mentality, causing investors to follow trends without careful analysis, resulting in poor financial decisions. Historical examples highlight the financial repercussions of these biases. The 2008 financial crisis was worsened by availability heuristics, as investors overestimated the housing market’s stability due to prolonged price increases. FOMO drove investors to purchase mortgage-backed securities without understanding their risks, contributing to a market collapse (Shiller, 2015). Similarly, during the 2017 Bitcoin surge, many investors, swayed by accessible success stories and media hype, succumbed to FOMO, leading to significant losses when the market declined. However, FOMO and availability heuristics can also yield positive outcomes. In emerging sectors like renewable energy or technology, FOMO has encouraged investments that later proved profitable. Investors capitalizing on accessible data about the rising demand for green technology have achieved substantial long-term gains (Baker et al., 2014). Additionally, FOMO can engage novice investors, enhancing financial inclusion and market liquidity.

FOMO and Investment Decisions

Since almost everyone now uses mobile phones, an essential part of everyday life, people are experiencing more FOMO since they spend more time in the virtual world. The “Fear of Missing Out,” or FOMO, is a typical feeling that may surface about the investing market. It is the uneasy or regretful sensation that someone may have when they think others are making money off of a particular investment opportunity while they are not (Shetty et al., 2023). Relationships between these factors have been identified via several research studies (Eide et al., 2018; Kang et al., 2020; Mostyn Sullivan et al., 2021) on FOMO and engagement conducted in a variety of industries (product, brand, social media, mobile phone, employment, social network, sports team, etc). According to this research, investors may suffer from FOMO and seek more information and investment news to allay their anxieties. This is because they have more financial investment options and want to make more money in riskier situations, especially among young people, who want to maintain connections on the social media sites in which they are interested. According to Cipriani and Guarino (2005), investors may disregard their own expertise to adhere to the timing of other investors’ choices. Based on research on FOMO in the literature and conversations among researchers on social media, consumer, brand, and financial involvement (Alt, 2018; Przybylski et al., 2013) Through their interactions with other investors, sharing their investments on social media and within their traditional circles, and tracking and comparing the profit and loss of both their own investment decisions and other investment choices that they have not invested in, it is evident that individual investors may try to stay aware of the investments of others in order to avoid missing out on developments related to their investments.

Conclusion

The study indicates that herd mentality, overconfidence, loss aversion, and availability heuristics together influence financial investment decisions via the lens of FOMO. Investors often yield to herd mentality and experience heightened FOMO as they worry about missing out on collective gains. The heightened FOMO on social media fosters a herd mentality when investors uncritically adhere to trends instead of cultivating their educated perspectives. This challenges beginner investors, exacerbating the already high market volatility. On the other hand, if one is overconfident, they may invest impulsively and believe in their skills to capitalize on chances to an excessive degree. While availability heuristics cause people to behave irrationally due to distorted views of current trends or vivid success stories, loss aversion links FOMO to the fear of missing out on possible earnings, which drives risk-averse or excessively cautious behaviors. These biases, using FOMO as a mediator, lead to investing decisions guided by emotions. In the future, researchers may use neuroeconomic approaches to uncover cognitive processes in experimental or longitudinal investigations, which might help them better comprehend these dynamics. Some other factors that can help us understand how to mitigate the influence of FOMO on investing choices include demography, market conditions, the effects of digital platforms, and the efficacy of behavioral interventions.

Suggestions and Policy Implications of the Study

Theoretical considerations suggest that traditional financial models must include psychological and emotional factors, such as the FOMO, which hinder rational decision-making. Social comparison prompts investors to prioritize short-term gains over long-term strategies. As an investor in management, you may mitigate the effects of emotional investing by enhancing financial literacy and promoting disciplined, long-term investment strategies. Government engagement, particularly on social media platforms, may diminish the occurrence of misinformation and rampant speculation. A further strategy to combat the FOMO is to advocate for long-term investment strategies that take environmental, social, and governance factors into account and create a healthy financial climate by educating people, regulating the industry, and using financial technology to help investors adopt more stable and reasonable investing practices.

To alleviate FOMO-induced market behavior, authorities should emphasize the improvement of financial literacy to assist investors in understanding biases, especially FOMO. They must mandate more openness from digital trading platforms and financial influencers, guaranteeing explicit risk warnings and disclosures of conflicts of interest. Regulating gamification elements, such as incentives and leaderboards in trading applications, helps mitigate impulsive behavior. Moreover, platforms must provide real-time risk alerts, especially for high-risk investments, while authorities must monitor social media to identify misinformation and market manipulation. Promoting long-term investment methods instead of short-term speculation is essential for cultivating a more stable market.

Limitations of the Study and Future Prospects

This article’s shortcomings stem from its dependence on current literature and conceptual frameworks, which may inadequately represent the intricacies of real-time market dynamics affected by FOMO and behavioral biases. The research mostly emphasizes psychological and theoretical dimensions, excluding actual data or real-world case studies, thereby limiting its practical usefulness.

Research in the future may make use of state-of-the-art techniques, such as artificial intelligence-driven sentiment analysis, to monitor investors’ actions on social media in relation to FOMO in real time or to forecast the impact of biases on investor behavior using machine learning models. To investigate the brain circuits linked to FOMO and bias-driven decision-making, researchers might use cutting-edge neuroeconomic methods, such as functional magnetic resonance imaging. Incorporating factors such as the function of algorithmic trading platforms, the effect of tailored investing applications, and the connection between digital platforms and financial influencers might also provide fresh aspects to the research. To get a new understanding of how to reduce irrational investing choices, it would be interesting to study how FOMO-driven behaviors vary between cultures or how financial knowledge and psychological resiliency moderate this impact.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Alt, D. (2018). Students’ wellbeing, fear of missing out, and social media engagement for leisure in higher education learning environments. Current Psychology, 37(1), 128–138. https://doi.org/10.1007/s12144-016-9496-1

Argan, M., Altundal, V., & Tokay Argan, M. (2023). What is the role of FoMO in individual investment behavior? The relationship among FoMO, involvement, engagement, and satisfaction. Journal of East-West Business, 29(1), 69–96. https://doi.org/10.1080/10669868.2022.2141941

Ansari, A., & Ansari, V. A. (2021). Do investors herd in emerging economies? Evidence from the Indian equity market. Managerial Finance, 47(7), 951–974. https://doi.org/10.1108/mf-06-2020-0331

Baker, K., Ricciardi, V., & Baker H. K. (2014). How biases affect investor behaviour. The European Financial Review, 7–10. http://www.europeanfinancialreview.com

Barberis, N., & Thaler, R. (2003). A survey of behavioral finance. In Constantinides G. Harris M. & Stulz R. (Eds.), Handbook of the economics of finance (pp. 1052–1090). Elsevier.

Bomnüter, U., Kleinselbeck, B., Reusch, H., & Schmidt, H. (2023). No limits? Effects of FOMO and gamification on individual investment behaviour in neo-broker stock trading [Conference session]. Annual Conference of the European Media Management Association (emma): Reorganization of media industries: Digital transformation, entrepreneurship and regulation (p. 18). https://doi.org/10.21241/ssoar.90870

Cipriani, M., & Guarino, A. (2005). Herd behavior in a laboratory financial market. American Economic Review, 95(5), 1427–1443. https://doi.org/10.1257/000282805775014443

Dar, F. A., & Hakeem, A. (2015). The influence of behavioural factors on investors’ investment decisions: A conceptual model. International Journal of Research in Economics and Social Sciences, 5(10). http://www.euroasiapub.org

Eide, T. A., Aarestad, S. H., Andreassen, C. S., Bilder, R. M., & Pallesen, S. (2018). Smartphone restriction and its effect on subjective withdrawal-related scores. Frontiers in Psychology, 9, Article 1444. https://doi.org/10.3389/fpsyg.2018.01444

Fama, E. F. (1997). Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics, 49(3), 283–306.

Ferreira, S. (2017). Gender: Behavioural finance and satisfaction with life. Gender & Behaviour, 15(3), 9550–9559. https://www.researchgate.net/publication/325271317

Friederich, F., Meyer, J. H., Matute, J., & Palau-Saumell, R. (2024). Crypto-mania: How fear-of-missing-out drives consumers’ (risky) investment decisions. Psychology and Marketing, 41(1), 102–117. https://doi.org/10.1002/mar.21906

Güngör, S., Küçün, T. N., & Erol, K. (2022). Fear of missing out reality in financial investments. International Journal of Business & Management Studies, 3(10), 53–59. https://doi.org/10.56734/ijbms.v3n10a4

Gupta, S., & Shrivastava, M. (2022). Herding and loss aversion in stock markets: Mediating role of fear of missing out (FOMO) in retail investors. International Journal of Emerging Markets, 17(7), 1720–1737. https://doi.org/10.1108/IJOEM-08-2020-0933

Hirshleifer, D. (2015). Behavioral finance. Annual Review of Financial Economics, 7, 133–159. https://doi.org/10.1146/annurev-financial-092214-043752

Idris, H. (2024). The effects of FOMO on investment behavior in the stock market. Golden Ratio of Data in Summary, 4(2), 19–25. https://doi.org/10.52970/grdis.v4i2.460

Ising, A. (2007). Behavioral finance and wealth management—How to build optimal portfolios that account for investor biases. Financial Markets and Portfolio Management, 21(4), 491–492. https://doi.org/10.1007/s11408-007-0065-3

Kang, I., Cui, H., & Son, J. (2019). Conformity consumption behavior and FoMO. Sustainability, 11(17), Article 4734. https://doi.org/10.3390/su11174734

Kang, I., He, X., & Shin, M. M. (2020). Chinese consumers’ herd consumption behavior related to Korean luxury cosmetics: The mediating role of fear of missing out. Frontiers in Psychology, 11, Article 121. https://doi.org/10.3389/fpsyg.2020.00121

Kaur, M., Jain, J., & Sood, K. (2023). “All are investing in crypto, I fear of being missed out”: Examining the influence of herding, loss aversion, and overconfidence in the cryptocurrency market with the mediating effect of FOMO. Quality & Quantity, 58(3), 2237–2263. https://doi.org/10.1007/s11135-023-01739-z

Kim, K., Lee, S. Y. T., & Kauffman, R. J. (2023). Social informedness and investor sentiment in the GameStop short squeeze. Electronic Markets, 33(1). https://doi.org/10.1007/s12525-023-00632-9

Mostyn Sullivan, B., George, A. M., & Brown, P. M. (2021). Impulsivity facets and mobile phone use while driving: Indirect effects via mobile phone involvement. Accident Analysis and Prevention, 150, Article 105907. https://doi.org/10.1016/j.aap.2020.105907

Naina, & Gupta, K. (2022). Sentimental herding in stock market: Evidence from India. Vision. https://doi.org/10.1177/09722629221133239

Noah, S., Tiur, M., Lingga, P., & University, S. G. (2021). The effect of behavioral factors in investor’s investment decision. ADI International Conference Series, 3(1), 398–413. https://adi-journal.org/index.php/conferenceseries/article/view/376

Nofsinger, J. R., & Sias, R. W. (1999). Herding and feedback trading by institutional and individual investors. Journal of Finance, 54(6), 2263–2295. https://doi.org/10.1111/0022-1082.00188

Przybylski, A. K., Murayama, K., DeHaan, C. R., & Gladwell, V. (2013). Motivational, emotional, and behavioral correlates of fear of missing out. Computers in Human Behavior, 29(4), 1841–1848. https://doi.org/10.1016/j.chb.2013.02.014

Riaz, L., Hunjra, A. I., & Azam, R. I. (2012). Impact of psychological factors on investment decision making mediating by risk perception: A conceptual study. Middle-East Journal of Scientific Research, 12(6), 789–795.

Sahi, S. K. (2017). Psychological biases of individual investors and financial satisfaction. Journal of Consumer Behaviour, 16(6), 511–535. https://doi.org/10.1002/cb.1644

Sahi, S. K., Arora, A. P., & Dhameja, N. (2013). An exploratory inquiry into the psychological biases in financial investment behavior. Journal of Behavioral Finance, 14(2), 94–103. https://doi.org/10.1080/15427560.2013.790387

Shetty, D., Kusane, S. M., Rote, S., Dhannur, V., & Gurav, V. (2023). Fear of missing out and herding behavior among retail investors in India: A systematic review. Journal of Data Acquisition and Processing, 38(2), 552–560. https://doi.org/10.5281/zenodo.7766381

Shiller, R. J. (2000). Measuring bubble expectations and investor confidence. Journal of Psychology and Financial Markets, 1(1), 49–60. https://doi.org/10.1207/S15327760JPFM0101_05

Shiller, R. J. (2015). Irrational exuberance (Rev. ed., 3rd ed.). Princeton University Press. https://doi.org/10.2307/j.ctt1287kz5

Shiva, A., Narula, S., & Shahi, S. K. (2020). What drives retail investors’ investment decisions? Evidence from no mobile phone phobia (nomophobia) and investor fear of missing out (I-FoMO). Journal of Content, Community and Communication, 10(6), 2–20. https://doi.org/10.31620/JCCC.06.20/02

Statman, M. (2014). Behavioral finance: Finance with normal people. Borsa Istanbul Review, 14(2), 65–73. https://doi.org/10.1016/j.bir.2014.03.001

Taffler, R. (2018). Emotional finance: Investment and the unconscious. European Journal of Finance, 24(7–8), 630–653. https://doi.org/10.1080/1351847X.2017.1369445

Tandon, A., Dhi,r A., Talwar, S., Kaur, P., & Mäntymäki, M. (2021). Dark consequences of social media-induced fear of missing out (FoMO): Social media stalking, comparisons, and fatigue. Technological Forecasting and Social Change, 171, Article 120931. https://doi.org/10.1016/j.techfore.2021.120931