1Department of Commerce, Punjabi University, Patiala, Punjab, India

2Department of Economics, Punjabi University, Patiala, Punjab, India

3Desh Bhagat College Bardwal, Dhuri, Punjab, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The Post Office Savings Bank engaged in financial services as a trust provider, promoting financial stability and savings culture. This study aims to analyse the growth and trends recorded by postal saving schemes from 2001–2002 to 2021–2022, focusing on receipts and outstandings across seven saving schemes. Additionally, the researcher attempted to compare these savings schemes using a paired t-test to determine the difference in receipts, and the growth of savings schemes was also checked using the compounded annual growth rate. The results highlighted that the Public Provident Fund (PPF) recorded maximum growth, with Kisan Vikas Patra reporting the lowest in the case of receipts. The highest outstandings were recorded by the Senior Citizen Savings Scheme (SCSS), whereas Kisan Vikas Patra (KVP) shows the least. A neutral trend has been recorded across all the savings schemes. The comparison reveals significant differences in the saving account (SB), followed recurring deposit (RD) Account. Results suggest the preference of investors for PPF and SCSS accounts, while savings accounts and RD are found popular due to stable performance. The policymakers should revisit the design of KVP to make it more appealing and performing.

Savings Scheme Analysis, Post Office Saving Account, Public Provident Fund, Outstandings and Receipts

Introduction

The Indian economy is growing in a significant phase where mobilisation of financial resources has been conducted using various investment options. In the last two decades, the significant transformation of the financial landscape has highlighted the emerging and vital role of postal savings in fund mobility and capital formation. Although there are numerous vehicles available for the intended mobilisation of savings, there are still few options meeting the needs of lower-income groups. Savings, being an important aspect of living, should be made with caution. Postal Saving schemes intend to meet the requirements of investors with lower incomes. The Post Office Savings Bank (POSB) provides multiple options of small savings to meet individuals’ convenience in availing cost-effective benefits, backed with government security (Sunder & Jacob, 2009). The bank engaged in providing seven savings schemes and three savings certificates to induce savings interest among its customers. Despite severe proliferation of digital banking, the savings of the post office continued to attract a large number of investors, especially in unreserved and rural areas. The postal network has recorded six-fold growth since independence, primarily focusing on rural areas (Ravindran & Venkatachalam, 2016). The rural people found savings in post offices attractive due to the guaranteed principal amount, along with attractive returns. Mathew (2020a, 2020b) reported more schemes, helping employees, quick services, strong network, safety and efficient returns as strengths of POSB in his research. Postal saving schemes have a positive influence over their investors, which acts as a great strength of the POSB (Usha & Miranda, 2020). A higher and regular return on these schemes helps the rural sections in better mobilisation of their funds. Even the performance of the India Post has gained a position in the market during the COVID-19 outbreak (Bhuvaneswari & Tamilarasi, 2020). The Indian postal department, since its establishment, has gone through different phases of growth. The study therefore aims to explore the potential of these savings in terms of growth, trends and popularity over the past two decades.

The different kinds of schemes attracted a larger amount, which ultimately helped the post offices to rehabilitate and enhance their profitability. Although the post offices are experiencing stiff competition from market forces, better returns and easy accessibility is somewhere helping the savings bank to meet these challenges. It, therefore, becomes imperative to analyse the growth and nature of schemes that are performing better and effectively.

Review of Related Literature

A review of the related literature helps to determine the framework of the study in relation to the research objectives and gaps identified. In this study, to analyse the trend of amount invested with saving schemes, growth recorded by saving schemes and to discover the schemes which gained maximum popularity among investors, the authors reviewed 48 related studies to offer useful insights related to the working of saving schemes.

For predicting the trend of small savings in India from 1950 to 1985, Shah and Parmod (1992) divided the savings growth into four phases: phase of low savings (1950–1968), the initial year of expansion (1968–1976), high savings phase (1977–1980) and stagnation phase (1980–1985). Prakash and Gurusamy (2018) tracked the growth of postal banking services from 2006 to 2016 and presented an upward trend of deposits with a yearly 94.6% increase, whereas amounts invested presented maximum growth in 2007–2008 with 8.57% in saving accounts. An analysis performed by Ashish and Singh (2018) presented the growth of deposits from 60.16 million in 2001 to 114.28 million in 2015. Total deposits recorded growth from 140,773.35 million in 2001 to 2,076,150.00 million in 2015. As per Tamarakar and Mani (2007), remarkable growth was recorded by savings in phase from 1984–1985 to 1995–1996, during which people highly invested in small saving schemes that came with tax rebate and were backed by state insurance, therefore marking it as a growth phase.

An empirical study of Salam and Kulsum (2002) revealed an upward household savings trend from 75.9% in 1980–1981 to 86% in 2007–2008. Deposit mobilisation in small savings, as per Kasilingam and Jayabal (2009) and Jain and Saluja (2016), generated greater revenue for the postal department because a greater amount of financial savings was being generated by postal savings (Mohan, 2008). Ramlal (1994) and Tendulkar and Umesh (2003) highly regarded small savings as the country’s viable financial option for the general masses, especially for people residing in rural areas. In India, the rate of savings has been consistently recording higher amounts compared to other countries. People used to invest in precautionary savings and found small savings more lucrative. As per Sinha (2017), interest rates of saving schemes proved much appealing to the masses, which were revised quarterly. Latterly, reduced interest rates of such schemes reduced the savings for plans less than five years. Declining interest rates of small savings discouraged the middle class, and therefore these needed to be framed strategically if the government wanted to shift savings towards other avenues, as per studies of Bhatnagar (2017), Mehta (2013) and Samudra and Burghate (2012).

Similarly, Moorthy (2001) recommended an inflation-adjusted formula for setting interest rates on provident funds and small savings for effective running. However, the safety and security provided by postal savings still encouraged people to invest in postal savings, as noted by Jothilakshmi and Santhi (2019), Ghosh (2007), Priyadarshee et al. (2010) and Sahoo and Gomkale (2015). Growing demand for saving schemes also attracted investment from people receiving disbursement of MGNREGA, social security pension schemes, Indira Gandhi National Old Age Pension Scheme, Indira Gandhi Matritva Sahyog Yojana and conditional cash transfer (CCT); these, therefore, induced an upward saving trend according to Malakar (2013).

Performance of the postal service was not impressive from 2005 to 2010 as per the compounded growth rate technique applied by Dl and Ramesh (2013) and therefore they suggested a strategic partnership with other financial institutions.

In Sankaran (2017), a positive compounded growth rate was reported in all saving schemes except the monthly income scheme, national saving certificate and Kisan Vikas Patra (KVP) scheme. Saranya and Hamsalakshmi (2018) studied the recent trend in saving plans using the simple percentage method, weighted arithmetic means, standard deviation and coefficient of variation, and the performance analysis of various schemes reflected 193.76% performance in the year 2007–2008. Eleven schemes of India Post proved useful to every investor. Mathew (2015) presented the growth of small savings through the savings bank from 99.88 million accounts in 1996 to 162.16 million accounts in 2005–2006. The saving schemes were performing well, and a positive growth rate was recorded for all schemes except KVP and National Savings Certificate, according to findings of Sankaran (2017) and Nagalakshmi (2015).

Among various saving schemes, the RD scheme gained more popularity due to its compulsory saving nature (Rajeswari, 2017). The KVP is another popular saving option that has attracted considerable funds from investors, especially in Coimbatore City (Karthikeyan, 2016). Postal deposits gained greater trust among working women in rural areas (Rameshkumar, 2018), whereas the PPF gained importance among government employees. A study on the performance of monthly saving schemes offered by banks and non-banking institutions reported that mutual fund schemes were more effective (Nandhini & Rathnamani, 2015). The recent launch of the Mahila Samman Saving Certificate bearing an interest rate of 7.5% started attracting a significant amount from women investors due to the benefits it offers (VA et al., 2023). Gavini and Athma (1999) found Indra Vikas Patra (IVP), Kisan Vikas Patra (KVP) and RD as popular schemes in urban and rural areas. Investors liked to invest more in the MIS, savings account, TD and RD as per the study by Ravindran and Venkatachalam (2016). In this way, different saving schemes of post offices attracted a greater amount in confronting the overall growth of small savings in India. People of Uthangarai taluk reported RD, post office savings account and monthly income scheme as the most popular schemes (Manimekalai & Ragunathan, 2021).

The above literature presented an overview of small savings in India and their performance. Existing studies lacked comprehensive comparisons among various postal schemes and were more focused on individual schemes. A more nuanced analysis of trends is also lacking to identify the factors responsible for the underperformance of schemes. The present study widens the scope by analysing the differences in saving schemes in the context of receipts of the last 21 years, along with the growth trend recorded by the saving schemes.

Research Objectives

Research Methodology

This study presents an empirical analysis of various saving schemes, including Post Office Saving Account, Monthly Income Scheme Account, National Savings RD Account, National Savings Time Deposit Account, Senior Citizen Savings Scheme, KVP and public provident fund (PPF).

This study used secondary data collected from the Handbook of RBI, that is, from 2001–2002 to 2021–2022, annual reports of India Post and other accessible sources, and analysed using tabulation in Microsoft Excel. Descriptive and statistical tools t-test, compounded annual growth rate (CAGR), trend analysis, line and bar charts were used to interpret the study.

Analysis and Interpretations

Saving schemes in the previous 21 years have undergone drastic changes. The present study empirically analyses the trend, growth and significant difference of the saving scheme. Time deposit account has not been considered for trend analysis due to the unavailability of sufficient data.

Trend of Receipts and Outstandings of Saving Schemes

This study intends to present the trend analysis of receipts and outstandings of each scheme with the help of tables and line charts from 2001–2002 to 2021–2022. The trend of receipts will help to understand the performance of each scheme and its role in generating funds from households for promoting capital formation in the Indian economy. Receipts for saving schemes mean the amount invested under different schemes by postal investors, and outstandings mean the balance left under different saving schemes, which constitute liabilities of the central government. Receipts and outstandings are expressed in crores, and the trend is presented in percentages by taking the previous year as the base year. The performance and trend analysis of postal schemes is presented using tables and line charts, as shown below.

With reference to Table 1 and Table 2, in Figure 1, receipts and outstandings recorded under SB are presented from 2001–2002 to 2021–2022 to understand the trend of the same. It was examined that receipts of SB revealed a positive trend till 2016–2017, a major downfall was observed in 2017–2018 due to reduced interest rate, and afterwards receipts started moving upwards. The outstandings also rose from 2001–2002 to 2021–2022, recording an upward trend in outstandings. Maximum receipts and outstandings of ₹247,446 crores and ₹205,888 crores were recorded in 2016–2017 and 2020–2021, respectively.

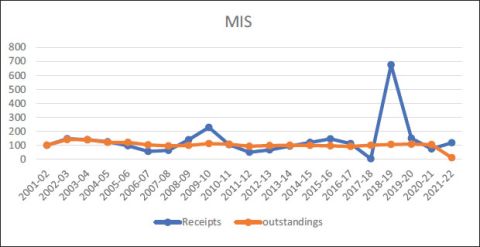

With reference to Table 1 and Table 2, in Figure 2 shows the trend of MIS schemes receipts and outstandings from 2001–2002 to 2021–2022. It was found that receipts with MIS have increased in the last 20 years, except in years, that is, 2007–2008, 2012–2013, and majorly in 2017–2018. This scheme has recorded a major outstanding balance, which is showing an upward trend in very recent years. Maximum receipts were received in 2010–2011 at ₹56,693 crore and the receipts received a major hit in 2017–2018, remaining 1,625 crores only. At the end of 2021–2022, MIS recorded the highest outstandings of ₹235,820 crores.

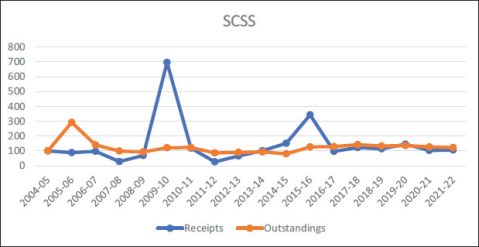

With reference to Table 1 and Table 2, Figure 3 depicts the trend of receipts and outstanding balance with SCSS, and it was in this context that SCSS reported an upward trend in receipts with little variation, and the same performance has been recorded in outstandings, which shows significant investment towards this savings scheme by senior citizens. SCSS was initiated in 2005 and, so far, has recorded ₹167,734.00 crores as receipts and ₹675,890 crores as outstandings. Overall, an upward trend was recorded in receipts and outstandings with SCSS.

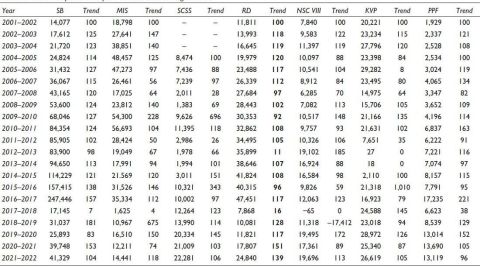

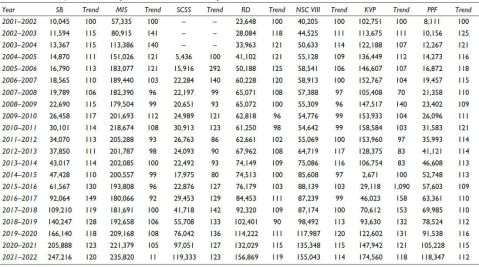

Table 1. Trend Analysis of Receipts with Post Office Saving Schemes.

Source: Handbook of Statistics on Indian Economy, RBI.

Note: Bold values indicate significant differences among groups of schemes.

Table 2. Trend Analysis of Outstanding Balance with Post Office Saving Schemes.

Source: Handbook of Statistics on Indian Economy, RBI.

Figure 1. Receipts and Outstandings under Post Office Saving Account (SB).

Figure 2. Receipts and Outstandings under National Monthly Income Statement.

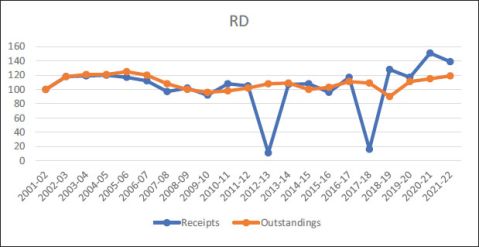

With reference to Table 1 and Table 2, Figure 4 shows the trend of receipts and outstandings under the RD account. An upward trend is shown in receipts except in 2017–2018, when a major downfall was recorded from 47,451 to 7,868 crore. An outstanding balance rose to ₹1,531,832 crore within the tenure of 21 years, as this account has a five-year maturity period. An upward trend was recorded by this in two phases, that is, before 2017–2018 and after it.

Figure 3. Receipts and Outstandings under the Senior Citizen Saving Scheme.

Figure 4. Receipts and Outstandings under the RD Account.

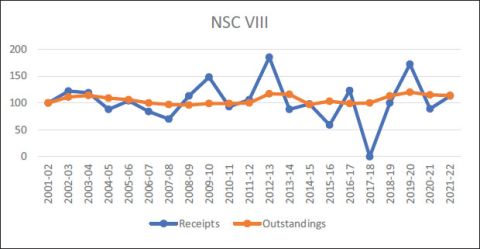

With reference to Table 1 and Table 2, Figure 5 shows receipts and outstandings recorded under the scheme NSC to analyse its trend. The figure shows that receipts with NSC VIII depict steady growth with little variation. In recent years, the receipts have been increasing with this scheme. On the other hand, the outstanding balance has also risen over the time span of 21 years. So far, this scheme has recorded 1,583,114 crores outstanding balance and 246,264 crores in receipts.

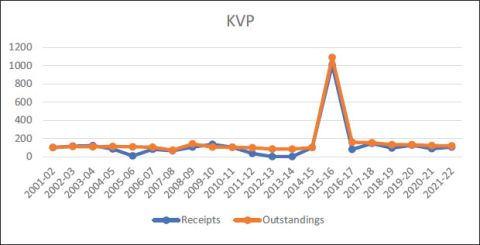

With reference to Table 1 and Table 2, Figure 6 analysed the trend of KVP from 2001–2002 to 2021–2022. The figure shows that receipts and outstandings declined over the years, and therefore a downward trend is reflected in the previous 21 years. KVP was discontinued in 2011 and relaunched in 2014. Therefore, no receipts were recorded in 2011, and the trend has gone upwards after 2014 with little variation.

Figure 5. Receipts and Outstandings under National Saving Certificate VIII.

Figure 6. Receipts and Outstandings under KVP.

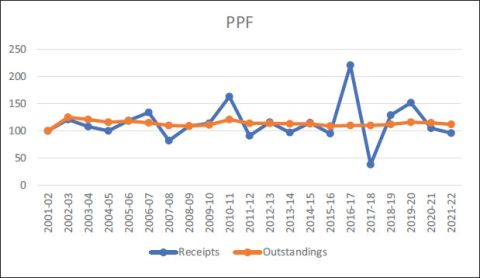

With reference to Table 1 and Table 2, Figure 7 presents the trend of receipts and outstandings from 2001–2002 to 2021–2022. The PPF scheme has flourished from 2001–2002 to 2021–2022 with a steady rate and has recorded a positive growth rate. On the other hand, an outstanding balance also increased in the previous 20 years. This scheme has recorded the highest growth and received an amount of 143,134 crores as receipts and 944,631 crores as outstanding balance . Overall, PPF recorded an upward trend in receipts and outstandings.

Figure 7. Receipts and Outstandings under PPF Account.

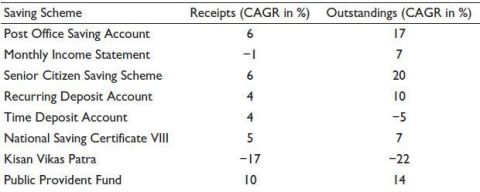

Table 3. CAGR of Saving Schemes.

Compounded Annual Growth Rate of Saving Schemes

Growth of postal saving schemes in the last 21 years, that is, from 2001–2002 to 2021–2022, has been investigated using the compounded annual growth rate: CAGR = (EV / BV)1 /N – 1, where EV is the ending value, BV is the beginning value, and N means the number of years.

Table 3 exhibits the growth rate of different saving schemes in the context of their receipts and outstandings in the previous 21 years. The table shows that all saving schemes are attracting funds positively every year except MIS and KVP. The potential reasons for negative MIS are declining interest rates and its suitability for the salaried class. Underperformance of KVP has been recorded since the scheme was discontinued in 2011 and relaunched in 2014, leading to the sale of KVPs from 2012 to 2018. Post Office SB, SCSS, RD and TD are growing at 6% and 4% CAGR. National Saving Certificate VIII recorded a 5% CAGR. The maximum growth rate is recorded by PPF at 10%. Meanwhile, an adverse growth rate of outstandings with saving schemes shows clearance of balances by the postal department. The given performance of schemes highlights the consideration of policymakers with respect to interest rate revisions, withdrawal rules, targeting marketing and maturity periods.

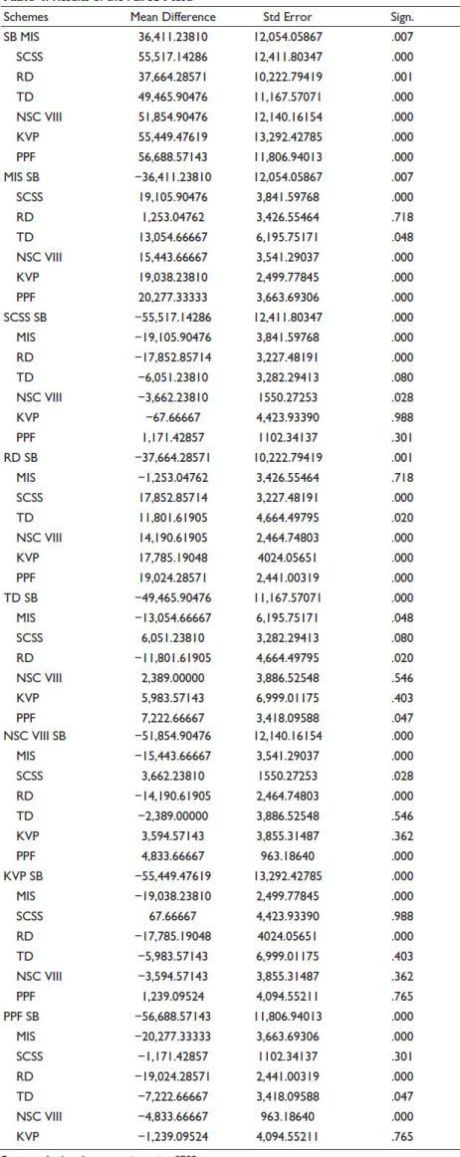

Analysing Differences in Receipts Among Saving Schemes Using the t-test

This study aimed to understand the difference in saving schemes with respect to their receipts. To verify the difference between the mean scores of each saving scheme and with other seven saving schemes, a paired t-test was run for each scheme. A total of 56 tests were performed to examine the difference between the mean scores of schemes by means of receipts.

In Table 4, a paired t-test was run on eight saving schemes to investigate the difference in their receipts simultaneously to understand if the saving schemes varied from one another in terms of their receipts. An analysis of the t-test showed that out of 56 tests, 30 paired tests showed significant results, meaning that a total of 30 pairs of saving schemes showed differences in their mean scores, or schemes differed reciprocally in terms of their receipts. Twenty-six paired tests, conversely, reflected insignificant differences among receipts of saving schemes, meaning that such schemes differ very little in terms of receipts. Each scheme was paired with the remaining seven schemes to present the difference effectively.

From Table 4, on considering pairs of significant differences or pairs with a p value less than .05, it was found that receipts of SB were significantly different from the other six schemes; in the case of the RD scheme, receipts vary from the other five schemes. PPF, MIS and NSC VIII showed differences in their receipts from the four schemes, respectively. SCSS and KVP revealed significant differences in their receipts from three schemes, whereas TD presented the least difference in mean score from the SB account only. The p value of significant results was highlighted in Table 4.

On the basis of counts of maximum significant results for schemes, the post office SB and the RD are the second most popular saving schemes of the POSB for 21 years.

Discussions

The findings of the study underscore that post office saving schemes have gone through tremendous growth from 2001–2002 to 2016–2017, which presented the great reliance on these schemes and their relevance in the Indian economy. The study furthermore observed that receipts got majorly hit in the year 2017–2018 because of the linkage of POSB and India Post Payments Banks, which also influence the spread of banking facilities (Minj et al., 2021). It might also be due to a shift towards other institutions or an increase in online payments. KVP was discontinued in between due to less response from the public. The underperformance of KVP in receipts and outstandings raises concerns, as observed in earlier studies (Deb & Paul, 2015). PPF emerged as the top performer in generating receipts, while SCSS outperforms in outstandings, aligning results with studies highlighting their performance (Pungalia et al., 2017; Ray & Shantnu, 2020). There is a need for further investigation into the underlying factors responsible for the neutral trend of savings schemes, as noted by Sinha (2017). The significant differences for the saving account followed by the RD account necessitate attention, particularly in view of studies highlighting the importance of flexibility and liquidity in saving plans (Shetti & Krithika, 2025). Therefore, the government can work on these aspects of schemes to improve investor appeal. Implementing technology-aided banking features and advertising through campaigns could help to increase the interest of more investors. Better interest rates and more withdrawal intervals could induce flexibility.

Table 4. Results of the Paired t-test.

Source: Authors’ computation using SPSS.

Note: The mean difference is significant at the 0.05 level.

Conclusion

The postal saving schemes have witnessed significant growth between 2001–2002 and 2021–2022. The present study aimed to analyse the trend in receipts and outstanding balance of these savings schemes, finding an upward trend with minimal variations in terms of receipts and outstandings, except for KVP, for which the policymakers can consider revamping the schemes in terms of revised interest rates, withdrawal rules and maturity period.

The PPF, showing the highest compounded growth rate, followed by SCSS, should be continuously supported by the policymakers through provided benefits and targeted marketing. Saving account and RD are recognised as popular schemes as per the results of the test, which also warrant adjustments relating to fees, interest rates for continuously meeting the needs of investors. A step towards investor education helps individuals to better meet investors’ requirements. Policymakers could also design targeted interventions such as improving liquidity options for schemes like MIS and savings accounts or improving returns for recurring deposits.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Ashish, S., & Singh, H. B. (2018). Analysis of trends in gross domestic and household savings and its components in India, Studies in Business and Economics, 13(1), 181–193.

Bhatnagar, A. B. (2017). Reduction in small savings interest rates: Middle class suffers (a critical review of small savings schemes of India). International Journal of Innovative Research and Advanced Studies (IJIRAS), 4(3), 381–385.

Bhuvaneswari, D., & Tamilarasi, S. (2020). Evaluating the patrons’ perception of performance of postal services during the COVID-19 outbreak in Chennai city. PalArch’s Journal of Archaeology of Egypt/Egyptology, 17(6), 2927–2933.

Deb, R., & Paul, A. (2015). Investors’ perceptions about Kisan Vikas Patra (KVP): Evidence from Agartala. Journal of Commerce and Accounting Research, 4(2), 27–43.

Dl, D. S., & Ramesh, D. (2013). Performances of Indian postal services. Innovare Journal of Business Management, 1(2), 5–10.

Ghosh, D. (2007). Financial inclusion through micro finance in India and emerging role of POSB: An analysis. All India Commerce Conference, Osmania University, Hyderabad, August 9.

Jain, B., & Saluja, M. (2016). Importance of Indian postal services for financial inclusion. Indian Scholar, 3(1), 12–18.

Jothilakshmi, E., & Santhi, P. (2019). A study on postal savings: An investment alternative to the rural areas. International Journal of Management and Social Sciences (IJMSS), 8(2.1), 19–22.

Karthikeyan, B. (2016). Investors’ attitude towards Post Office deposit schemes. Indian Journal of Applied Research, 6(9), 303–305.

Kasilingam, R., & Jayabal, G. (2009). Fund mobilisation in small saving schemes: A critical review. ICFAI Journal of Management & Business Studies, 5(4).

Malakar, D. (2013). Role of Indian post in financial inclusion. IOSR Journal of Humanities and Social Science (JHSS), 6(4), 4–7.

Manimekalai, R., & Ragunathan, T. (2021). A study on the postal saving scheme in sub post office special reference to Uthangarai Taluk. International Journal of Aquatic Science, 12(2), 219–227.

Mathew, S. (2015). Strategic role of Post Office Savings Bank towards prosperity of India. Journal of Exclusive Management Science, 4(1), 1–6.

Mathew, S. (2020a). SWOT analysis on Indian postal schemes: Study on the Post Office Savings Bank of Kerala circle. International Journal of Scientific Development and Research, 5(10), 213– 223.

Mathew, S. (2020b). Effect of brand on customer loyalty: A study on the Post Office Savings Bank of Kerala circle. International Journal of Scientific Development and Research, 5(10), 78–97.

Mehta, R. (2013). Trends and patterns of household saving in India (pre and post economic reforms). The Global eLearning Journal, 2(2), 1–19.

Minj, M., Mishra, A. K., Soni, R. K., & Kalyan, P. G. (2021). Impact of India Post Payments Bank on post office saving accounts. Sambodhi (Indological research journal of LDI I), 44(3), 7–13.

Mohan, R. (2008). The growth record of the Indian economy, 1950–2008: A story of sustained savings and investment. Stanford Centre for International Development.

Moorthy, V. (2001). Setting small savings and provident fund rates, Economic & Political Weekly, 36(41), 3941– 3949.

Nagalakshmi. (2015). A study on performance and consumer preference of India post in Virudhunagar district [PhD thesis, Madurai Kamraj University].

Nandhini, T., & Rathnamani, V. (2015). A study on the performance of monthly saving schemes offered by banking and non-banking institutions. International Journal of Management & Business Studies, 5(4), 47–50.

Prakash, N., & Gurusamy, S. (2018). India postal banking services: A study on its growth. SUMEDHA Journal of Management, 7(3), 109–120.

Priyadarshee, A., Hossain, F., & Arun, T. (2010). Financial inclusion and social protection: A case for India Post. Competition & Change, 14(3–4), 324–342.

Pungalia, S., Goyal, V., & Arya, M. K. (2017). A study on preferred investment avenue among senior citizens with reference to Indore city, India. Aweshkar Research Journal, 23(2), 104–113.

Rajeswari, M. (2017). A study of customer preferences of recurring deposits in Post Offices over Banks. Asian Social Science, 13(7), 103–106.

Rameshkumar, N. (2018). Investor attitude and saving pattern towards Post Office Saving schemes: A study with special reference to rural working women of Pollachi Taluk in Coimbatore district. International Journal of Management, IT & Engineering, 8 (10), 89–100.

Ravindran, G., & Venkatachalam, V. (2016). Investment opportunities of postal services in India. International Conference on ‘Research Avenues in Social Science’ Organised by SNGC, Coimbatore, 1(3), 226– 229.

Ray, M., & Shantnu, R. (2020). A comparative analysis on the awareness in small savings scheme with reference to Sukanya Samriddhi account and public provident fund. Journal of Development Research, 13(4), 53–61.

Salam, M. A., & Kulsum, U. (2002). Savings behaviour in India: An empirical study. The Indian Economic Journal, 50(1), 87–89.

Sahoo, M. K., & Gomkale, M. (2015). Financial inclusion in India: An empirical study of unorganized sector in Gujarat. Information Management and Business Review, 7(5), 5–15.

Samudra, A., & Burghate, M. A. (2012). A study on investment behaviour of middle class households in Nagpur. International Journal of Social Sciences and Interdisciplinary Research, 1(5), 43–54.

Sankaran. (2017). Customer loyalty on financial services of India Post: A study with reference to Kerala [PhD thesis, School of Management Studies, Cochin University of Science and Technology].

Saranya, K., & Hamsalakshmi, R. (2018). Performance of Indian Post Office Saving schemes in recent trends. International Journal of Advanced Research, 6(3), 998–1004.

Shetti, A., & Krithika, J. (2025). Recurring deposit as an instrument of savings: A study. EPRA International Journal of Multidisciplinary Research (IJMR), 11(4), 330–339.

Sinha, P. (2017). A study on the small saving schemes in India and their impact on the general masses. Global Journal for Research Analysis, 6(3), 463–464.

Sunder, G., & Jacob, P. (2009). Post office savings and its relevance in rural areas: A study on the impetus for rural investment with reference to Kumbalangi in Cochin. The Indian Journal of Management, 2(1), 26–34.

Tendulkar & Umesh. (2003). Pattern of rural saving and its investment: A case study of Nalbari district. Gauhati University. http://hdl.handle.net/10603/67650

Usha, M., & Miranda, M. M. (2020). Customer perception towards investment in Post Office schemes. International Journal of Multidisciplinary Educational Research, 9(10), 5–15.

VA, N. A., Aithal, P. S., & Pankaje, N. (2023). A comparison of the Mahila Samman savings certificate with other small savings schemes for the empowerment of women in India. International Journal of Case Studies in Business, IT and Education (IJCSBE), 7(2), 348–359.