1Punjabi University Patiala, Punjab, India

2Department of Commerce, Punjabi University Patiala, Punjab, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The dividend policy is essential to all parties connected to the business. Although it is believed that dividend payments impact the market share prices, there is another belief that they deplete corporate reserves and may result in a liquidity crisis for business initiatives. This study aims to investigate the price response to dividend announcements made by 182 companies listed on the National Stock Exchange between 2010 and 2022. The average of the share prices prior to and following the dividend announcement was derived for this purpose. The effect of dividend announcements on share prices has been investigated using the paired t test. The findings indicate that in the majority of the industries, dividend announcements had no statistically significant effect on share prices. The investigation reveals important findings regarding investor expectations for dividends and market behavior.

Dividend announcements, share price, National Stock Exchange (NSE)

Introduction

A number of factors, such as the size of the distribution, the company’s financial performance, and the state of the market, can affect how exactly a dividend announcement affects a company’s share price. A corporation is generally in good financial standing when it announces a dividend payment, indicating that it has additional cash flow to provide to its shareholders. Investors may see this as a sign of strength since it means the business is making money and can pay out dividends to shareholders. Investors may receive a signal from a dividend payment that the business is adhering to sound corporate governance principles (Pani, 2008). As a result, anticipation of the dividend payment may cause the share price to increase. Investors may, however, see a company’s announcement of a lower-than-expected dividend payment or no dividend payment at all as a bad indication. This could cause the share price to drop since it indicates that the business is either not making as much money as anticipated or holding onto its cash rather than giving it to shareholders. A dividend announcement is arguably among the most important elements of an organization’s financial policies because dividends are a key indicator of its solvency, financial soundness, management effectiveness, and overall progress (Raja et al., 2015). Declaring dividends is seen by many businesses as a wise move because it enhances their stock price and reputation. According to Modigliani and Miller (1961), investors are unconcerned about the dividend’s size in a perfect market because it has minimal bearing on the firm’s valuation (Gupta et al., 2012). The purpose of this study is to investigate the relationship between dividend announcements and changes in share prices that follow. Therefore, it would be fascinating to see how the announcement of a dividend affects the share prices of huge firms.

Literature Review

Ali and Waheed (2017) made an attempt to research how share price volatility is affected by dividend policy. The top 10 companies listed on the Pakistan Stock Exchange were examined for this purpose. According to the study, companies that distributed dividends to their shareholders on a regular basis had more stable stock prices. Narzary and Biswal (2021) also found a positive impact of dividend declaration on the stock return of 80 BSE-listed companies. Hunjra et al. (2014) attempted to examine how the dividend payout ratio affected Pakistani stock prices and discovered that it had a favorable effect. Iqbal (2014) attempted to investigate how dividends affected the pricing of shares of firms in the KSE 30 index between 2002 and 2012. The share price was chosen as the control variable, along with price–earnings ratio, dividend yield, dividend payout, profitability ratio, and return on equity. The study found a favorable effect of every variable on the prices of the shares of the chosen companies, except price–earnings ratio and dividend yield. Kandpal and Kavidayal (2015) examined how the dividend policies of 30 chosen Indian banks listed on BSE affected the wealth of their shareholders and found a major effect of it on the price of shares. Khalid and Shawawreh (2014) investigated the connection between dividend policy and share price volatility of companies listed on the Jordanian stock exchange that represent four industries (banking, insurance, services, and industrial) and found a negative correlation between them. Mutiara et al. (2024) analyzed 81 firms that satisfied the 2017–2021 high dividend index criteria in an attempt to investigate the impact of dividend policy on company value. The study discovered that dividend policies increased the value of the company. Narzary and Sharif (2015) examined how the dividend policy affected the stock prices of KSE-100 index-listed 45 nonfinancial companies that paid dividends for 12 years starting in 2001 and found a positive correlation between them. Zakaria et al. (2012) examined how the dividend policy affected the share price volatility of 77 construction and material companies listed between 2005 and 2009 on the Bursa Malaysia stock exchange in Kuala Lumpur. The study discovered that a company’s size has a major impact on share price volatility.

Research Methodology

This study looks at how dividend announcements affect the share prices of companies that are listed on the national stock exchange. A final sample of 182 companies that pay a regular dividend has been chosen from the population of Nifty 500 companies. The study’s 13-year timeframe was from 2010 to 2022. The data have been subsequently categorized into 11 sectors based on the industry’s characteristics. The share prices have been averaged for the day and the day after the dividend announcement. The paired t test was used to examine the data that were gathered from the PROWESS database, the NSE website, and the companies’ annual reports.

Analysis of Data with the Help of “t Test”

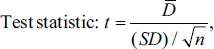

This test is employed when the samples are dependent, meaning that either two samples have been matched or “paired” or only one sample has been analyzed twice (repeated measurements). The paired “t test” is used to determine how dividends affect share prices. Here, data of share price both before and after the dividend was declared has been gathered and tabulated to enable precise computations and the use of the “t test.” The paired t test equation is as follows:

,

,

where .png) is the mean of difference, SD is the standard deviation of differences, and n is the number of matched pairs.

is the mean of difference, SD is the standard deviation of differences, and n is the number of matched pairs.

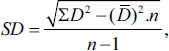

In which:

,

,

Level of significance: 5%.

n – 1 = degree of freedom.

Decision rule: H0 is deemed significant and accepted if the computed value of “t” is smaller than the tabulated value.

Hypothesis

H0: There is no significant difference between the average share prices of the chosen companies before and after they announce dividends.

H1: There is a significant difference between the average share prices of the chosen companies before and after they announce dividends.

Data Analysis and Interpretation

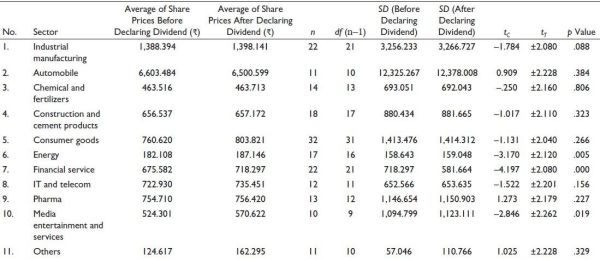

The results of the paired t test, to determine the effect of the dividend announcement on share prices, are shown in Table 1.

The average share price before and after the dividend announcement, the number of companies in a given industry (n), the degree of freedom (df), the standard deviation, the computed value (tC), the table value of T (tT), and the test’s p value are all included in the table. The average share price in Sector 1 (industrial manufacturing), which consists of 22 companies, was 1,388.394 prior to the dividend announcement; following the announcement, it rose to 1398.141. At 21 degrees of freedom (n–1), according to the results, there was an insignificant rise in share prices following the dividend announcement. Since the computed value of t (–1.7842) is less than the tabulated value (±2.080) with a p value of .088; hence, H0 is accepted. This shows that the average share prices of chosen firms before and after they announced dividends did not differ significantly. Regarding sectors 2, 3, 4, 5, 8, 9, and 11, comparable findings were obtained. The computed value of “t” is lower than the tabular value in each of these sectors. H0 is deemed to be acceptable in each of these sectors since the p value is greater than the 5% level of significance. The findings showed that the relationship between dividend changes and future profitability does not align with the signaling hypothesis’s expectations. However, the average share price of Sector 6, which consists of 17 companies, was 182.108 prior to the dividend announcement and rose to 187.146 following the announcement of the dividend. At 16 degrees of freedom (n – 1), the results indicate a large increase in share prices following the dividend announcement. H0 is rejected since the computed value of t (–3.170) is more than the tabulated value (±2.120) with a p value of .005. This indicates that the average share prices of chosen firms before and after they announced dividends in this specific industry fluctuate significantly. Sectors 7 and 10 show comparable outcomes. The computed value of “t” in these sectors is likewise greater than the tabular value. This suggests that H0 is rejected in both sectors since the p value is below the 5% level of significance. This shows that the average share prices of chosen firms before and after they announced dividends differed significantly. The results of the studies by Kaluarachchi (2019), Shukla (2011), Bhatia (2015), and Kaviben (2017) are comparable to these findings.

Table 1. Paired Sample t Test.

Conclusion

The dividend policy is an important policy for shareholders. Finding the effect of dividend announcements on the share price of the chosen NSE-listed firms between 2010 and 2022 constitutes the focus of this investigation. According to the study, the share prices of chosen companies in the following sectors—industrial manufacturing, automobiles, chemicals and fertilizers, construction and cement products, consumer goods, IT and telecom, pharmaceuticals, and others—showed little volatility or unusual changes before and after the dividend announcement date. Because the dividend announcement has little effect on the share prices of all of these industries, the average prices of the shares do not significantly rise or fall. Simultaneously, the analysis discovered that the average share prices in just three sectors—energy, financial services, and media entertainment and services—rose significantly following the dividend announcement. Therefore, it is reasonable to state that after dividends are announced, the share prices of these three industries tend to increase. For managers, investors, lenders, and other stakeholders, the study’s findings are significant and helpful. It is significant to investors because they perceive dividends as a means of evaluating companies from an investing perspective, in addition to as a source of income. The management must use the findings to create a dividend policy that optimizes shareholder wealth.

Limitations

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding

The authors disclosed receipt of the following financial support for the research, authorship, and/or publication of this article.

Ali, T., & Waheed, N. (2017). Impact of dividend policy on share price volatility. Research Journal of Finance and Accounting, 8(9), 43–49.

Bhatia, P. (2015). Dividend announcement effects on stock returns of companies listed at BSE and NSE_A sectoral study [PhD thesis, School of Management Studies, Indira Gandhi National Open University IGNOU].

Gupta, S., Dogra, B., Vashisht, A. K., & Ghai, S. (2012). Stock price reaction to dividend announcements. International Journal of Financial Management, 2(2), 23–31.

Hunjra, A. I., Ijaz, M. S., Chani, M. I., Hassan, S. U., & Mustafa, U. (2014). Impact of dividend policy, earning per share, return on equity, profit after tax on stock prices. International Journal of Economics and Empirical Research, 2(3), 109–115.

Iqbal, A. (2014). The effect of dividend bubble on share price: Evidence from KSE-30 index. Research Journal of Finance and Accounting, 5(13), 83–87.

Kaluarachchi, D. (2019). Impact of dividend announcement on stock price: Empirical evidence of Colombo stock exchange. Journal of Accounting, Finance and Auditing Studies, 5(1), 213–225.

Kandpal, V., & Kavidayal, P. C. (2015). A study of dividend policy and its effect on market value of shares of selected banks in India. IOSR Journal of Business and Management, 17(1), 41–44.

Kaviben, Z. (2017). An impact of dividend on market value of equity shares of selected petroleum refineries in India [PhD thesis, Department of Commerce. Saurashtra University].

Khalid, F., & Shawawreh. (2014). The impact of dividend policy on share price volatility: Empirical evidence from Jordanian stock market. European Journal of Business and Management, 6(38), 133–143.

Miller, M., & Modigliani, F. (1961). Dividend policy, growth, and the valuation of shares. The Journal of Business, 34(4), 411–433.

Mutiara, S., Hapsari, I., & Budi, S. (2024). Effect of profitability, leverage, and liquidity on company value with dividend policy as a moderation variable (in IDX high dividend companies 20 period 2017–2021). Formosa Journal of Applied Sciences, 2(1), 1–24.

Narzary, D., & Biswal, K. C. (2021). Impact of dividend announcements on stock returns: An empirical study of Indian companies. Urkish Online Journal of Qualitative Inquiry, 12(7), 713–724.

Pani, U. (2008). Dividend policy and stock price behaviour in Indian corporate sector: A panel data approach. https://ssrn.com/abstract=1216171

Raja, A., Sangani, J., & Joshi, K. (2015). Dividend declaration and stock price behavior: Indian evidences. Sankalpa, 5, 9–12.

Sharif, I., Ali, A., & Ali, F. (2015). Effect of dividend policy on stock prices. Business & Management Studies: An International Journal, 3(1), 56–87.

Shukla, O. (2011). An investigation to review the impact of dividend on share prices of Indian companies [PhD thesis, Department of Commerce, Saurashtra University].

Zakaria, Z., Muhammad, J., & Zulkifli, A. H. (2012). The impact of dividend policy on share price volatility: Malaysian construction and material companies. International Journal of Economics and Management Sciences, 2(5), 1–8.