1Mehr Chand Mahajan DAV College for Women, Chandigarh, India

2University Business School, Panjab University, Chandigarh, India

3PG Department of Commerce, Mehr Chand Mahajan DAV College for Women, Chandigarh, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The well-being of an economy depends mostly on a multitude of aspects which work jointly to maintain the economy of any country running. Financial literacy, saving behaviour and entrepreneurial intention are a few of these aspects which play a quintessential role in the smooth functioning of an economy, and hence it is pertinent to delve into these factors. As an outcome, the primary aims of this research study are to utilize primary data and to measure the diverse relationships among these factors. The objectives of this research article are to measure the connection amongst saving behaviour and financial literacy, entrepreneurial intention and financial literacy, and entrepreneurial intention and saving behaviour. A total of 169 respondents from various states of northern India became a part of this research study. A convenience method of sampling was used for the selection of the sample, and required figures were collected with the use and help of online questionnaires. Hypotheses were formed, and different statistical computations and calculations were applied for testing various hypotheses. Many meaningful inferences were made, and the findings offer insights for financial institutions and policymakers to make a valuable contribution to this field of research.

Financial literacy, entrepreneurial intention, saving behaviour, Northern India

Introduction

Financial literacy is the aptitude to understand and utilize fundamental concepts related to finance while dividing financial resources for investment and identifying market opportunities (Li & Qian, 2020). It focuses on and refers to the capability of a person to oversee their personal finances. Individuals who are experts at managing their finances will effortlessly fulfil their future obligations. Financial literacy deals with individuals’ financial security (Ali et al., 2021). Many researchers (Hilgert et al., 2003; Klapper et al., 2015; Li & Qian, 2020) recognized that highly financial literate people have the capability of managing risk and identify various business opportunities, which can lead to understanding of entrepreneurial development and growth and helps in gaining financial knowledge.

These days, as the improved standard of living and stable financial health are gaining importance, international financial markets are offering a wide range of investment opportunities. Financial planning is becoming more of an acceptable practice. Among the current deviations in financial markets related to finance, it is more important nowadays for consumers to manage their finances with greater knowledge and skill. The factor responsible for this is the fact that modifications in financial markets have a greater variety of products related to investment and finance and financial services available, necessitating the making of complex decision-making for finance.

Financial literacy fosters the cultivation of market knowledge, familiarity with financial insight, finance sources and entrepreneurial aspirations among individuals (Hilgert et al., 2003; Levesque et al., 2009; Li & Qian, 2020). Entrepreneurial intentions help engage people in various entrepreneurial activities. Being an entrepreneur is a valuable career choice. Self-reliance and self-direction are becoming more and more preferred in individual job choices (Baruch, 2004; Gibb, 2002a, b; Hall, 2002). The term ‘entrepreneurship’ has been defined as beginning one’s own firm or a work attitude that prioritizes initiative, self-reliance, risk-taking and creativity (Bruyat & Julien, 2001). Entrepreneurship is mainly considered a risky prospect, although encouraging entrepreneurship will lead to increased economic development and poverty alleviation.

A nation’s economic forecasts and well-being are enhanced by entrepreneurship, which also generates income, expands job opportunities and increases demand across a range of industries (Acs & Szerb, 2010; Morrison & Johnson, 2003; Sadler-Smith, 2003; Timmons, 1999). Entrepreneurs who are in the budding stage, they must have financial awareness and develop the habit of saving money. Potential entrepreneurs are individuals who have high self-confidence, risk tolerance and willingness to innovate (Koh, 1996; Nasip et al., 2017). As per Krueger et al. (2000), entrepreneurial intentions refer to a person’s choice to start a business, their natural inclination towards entrepreneurship and their attitude and expectations about being involved in entrepreneurial activities.

To smoothly and successfully run a business, entrepreneurs need to be financially stable and literate. Studies reveal that their operations are restricted by a lack of financial knowledge and inefficient management. They must, therefore, be able to fill in the gaps by making up for any shortcomings in the financial market to assist the entrepreneurial process. Like high-income countries, in lower-middle income countries, entrepreneurship promotion has grown significantly since it fosters entrepreneurial qualities and increases a nation’s ability to compete and prosper economically. The economy benefits from saving because money invested in financial assets is then used by businesses to finance their investments through financial intermediaries.

Saving behaviour and even entrepreneurial intentions affect financial literacy directly and indirectly. Saving is mostly that portion of income which is not spent. Savings are necessary for the nation’s economy to grow since low savings rates reflect towards poor investment and low capital formation. A nation’s high savings rate can also protect it from financial crises and recessions. According to Horrod (1939) and Domar (1946), the ability to save money and the savings rate influence how quickly the economy is growing because more savings will affect a greater degree of investment in the nation, which in exchange promotes national economic growth. Saving behaviour helps in attaining financial objectives and creating wealth. Individuals with strong saving behaviour have a greater probability of gathering capital to invest and have all the required resources for pursuing all available entrepreneurial opportunities.

Literature Review and Hypothesis Development

Financial Literacy

According to Brown et al. (2006), financial literacy is the ability and competency that facilitates individuals to respond effectively to ever-changing personal and economic circumstances. Garman and Forgue (2006) defined financial literacy as having adequate knowledge of facts and terms required for successful personal financial management. Furthermore, according to the definition propounded by Anthen (2004), financial literacy means having the capability to know, analyse, manage and talk about your personal financial situation. Huston (2010) proposes that financial literacy is a skill that helps people to make financial decisions effectively. It is necessary to take sound financial decisions related to investment and ultimately achieve one’s own financial goals and well-being. Financial literacy, according to the OECD, involves having awareness, knowledge, skills, attitudes and behaviours related to money matters. According to Chen and Volpe (1998), financial knowledge includes general knowledge related to personal finance, savings and loan, insurance and investment.

Saving Behaviour

In economics, saving means the money that has left after you have spent on your needs and wants over a specific time period (Browning & Lusardi, 1996; Warneryd, 1999). In general, we can define saving as that part of income that is not consumed (Lee & Hanna, 2015). Saving is seen as crucial for fostering long-term economic growth and establishing a link amongst a country’s past, present and future. Total savings represent the portion saved from the current income. The primary reasons for saving include preparing for future transactions, as a precautionary measure, and for speculative purposes.

Entrepreneurial Intention

Akanbi (2016) propounded that entrepreneurship is not only about finding and filling gaps in the market but also about a process of discovering the true entrepreneurial potential, evaluating the risks and taking chances to create future products. According to Fuadi (2009), the entrepreneurial interest is demarcated as a wish and readiness to work rigid without being anxious about the financial risk that will occur in entrepreneurship, and also willing to gain knowledge from the breakdowns. According to Hermawan (2005), the entrepreneurial interest is an attraction in a person towards entrepreneurial activity, and their wish to be involved in entrepreneurial activity.

H1: There is an association between financial literacy and saving behaviour.

This research work is built upon the first hypothesis that there exists a relation between financial literacy and saving habits. Various studies have delved into the correlation of these variables. According to Sulong (2017), there is a positive correlation between saving behaviour and financial literacy. Students who have higher levels of financial knowledge are more likely to save or invest. Clark and Madeleine (2008) showed that addressing the problem of decreased savings can be effectively tackled through financial literacy initiatives and financial planning. Also, Mahdzan (2013) found that literacy related to finance indirectly impacts household saving behaviour by significantly affecting the planning. Afsar et al. (2018) found that students who have higher financial literacy tend to exhibit more saving behaviour compared to those students who have lower financial literacy. Mahdzan (2013) demonstrated that financial literacy plays an indispensable role in determining individual saving habits. Jamal et al. (2015) suggested through multiple regression statistical tools’ analysis that family and peers and financial literacy are influential factors on students’ saving behaviour. Sabri and MacDonald (2010) similarly concluded that possessing financial literacy meaningfully impacts the saving behaviour of college-going students. Stolper and Walter (2017) argued that financial literacy benefits individuals, businesses and families by promoting wise saving and investment practices. Mahdzan and Tabiani (2013) discovered that financial literacy positively influences personal savings. Furthermore, Mohamad Fazli and MacDonald (2010) highlighted that individuals who have better financial literacy and saving behaviour are inclined to have fewer financial problems, indicating a negative correlation.

H2: There is a correlation between financial literacy and entrepreneurial intention.

Our study’s second hypothesis suggests a correlation between financial literacy and entrepreneurial intention. Financial literacy mainly influences entrepreneurial intentions, as persons who have a better level of financial literacy incline to pursue entrepreneurial endeavours (OECD, 2019). In high-income countries compared to lower-middle income countries, Gnyawali and Fogel (2014) discovered that financial knowledge motivates people to jump into their own business. Hilgert et al. (2003) and Bilal et al. (2021) also found a correlation between understanding money and the desire to become entrepreneurs. Ojogbo et al. (2022), however, reported no correlation between financial literacy and entrepreneurial intention. Conversely, Song et al. (2020) mentioned a positive association between entrepreneurial intention and financial literacy. According to Aldi et al. (2019), financial literacy influences entrepreneurial interest. Additionally, Bilal et al. (2021) stated that better financial knowledge and attitudes boost the chances of activities of the entrepreneurial intentions amongst youth. Kang et al. (2024) suggested that financial literacy partially positively affects entrepreneurship and entrepreneurial intention. Ojogbo et al. (2022) also proposed in the research study that entrepreneurship education positively impacts entrepreneurial intentions of graduates.

H3: There exists a correlation between saving behaviour and entrepreneurial intention.

Shrestha and Rawat (2023) found strong positive connections between saving money and the desire to commence a business. Their research highlights the role of saving for aspiring entrepreneurs, as it assists in resource accumulation, promotes financial responsibility and demonstrates commitment to business endeavours. Similarly, Amofah et al. (2020) found a relation between saving money and entrepreneurial aspirations, which suggests that people who save more money are more inclined towards business ownership. Moreover, saving money reflects a skill of an individual to delay gratification and focus on long-term goals, essential qualities for entrepreneurship (Cho, 2009; Dunn & Holtz-Eakin, 2000; Kilara & Latortue, 2012). Developing good saving habits can foster an entrepreneurial mindset and facilitate wealth accumulation (Bosumatari, 2014). Entrepreneurial success is closely associated with prudent saving practices, as saving serves as a resource to gather funds (Erskine et al., 2006; Rikwentishe et al., 2015).

Research Methodology

Research Hypotheses

This research is based on the following hypotheses:

H01: There is no association between financial literacy and saving behaviour.

H02: There is no correlation between financial literacy and entrepreneurial intention.

H03: There is no correlation between savings behaviour and entrepreneurial intention.

Research Objectives

This study is undertaken to fulfil the following objectives:

Data Collection

The study employs a mix of convenience methods of sampling, wherein the respondents were selected as per the requirements of this study. A total of 169 respondents became part of the research study, which included both males and females with varied designations. The questionnaire method was utilized for the entire data collection wherein questionnaires were designed and thereafter circulated online.

Instrument Design

For achieving the objectives of the research study, three parameters were utilized: financial literacy, saving behaviour and entrepreneurial intention. For financial literacy, a complete set of nine indicators was selected, drawn from the works of Ali et al. (2022) and Harahap et al. (2022). Regarding saving behaviour, eight indicators were chosen, adapted from Ali et al. (2022) and Zulaihati et al. (2020). Lastly, eight indicators were employed for measuring entrepreneurial intention, with questions modified to ensure clarity and understanding among respondents.

Data Analysis

For this study, the SPSS software was used to calculate the correlation among various variables. As described above, this study intends to analyse three relationships: first, between financial literacy and saving behaviour; second, between financial literacy and entrepreneurial intention and, third, between saving behaviour and entrepreneurial intention. This section presents the results of these associations.

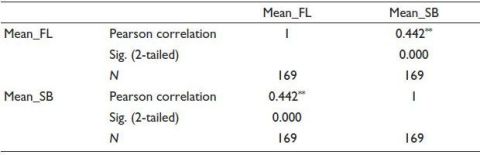

Table 1 explains the association between financial literacy and saving behaviour. Based on Table 1, we deduce that the correlation coefficient between these two variables is 0.442. This directs a statistically significant positive correlation between financial literacy and saving behaviour, suggesting a direct relationship between the two. In simpler terms, individuals with greater levels of financial literacy tend to save more money. This finding aligns with the conclusions drawn by Sulong (2017), Mahdzan (2013), Afsar et al. (2018), Jamal et al. (2015) and Sabri and MacDonald (2010).

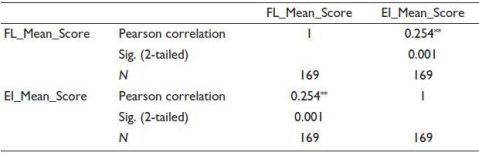

Table 2 demonstrates that the correlation between financial literacy and entrepreneurial intention is also positive and statistically significant at 0.245. This indicates that the individuals with higher financial literacy are expected to harbour higher entrepreneurial intentions. However, a correlation coefficient of 0.245 suggests a weak to moderate positive relationship amongst these variables, implying that while there is a tendency for those with greater financial knowledge to exhibit an inclination towards starting a business, the association is not exceptionally strong. This finding resonates with the conclusions drawn by Gnyawali and Fogel (1994), Hilgert et al. (2003), Song et al. (2020), Aldi et al. (2019), Bilal et al. (2020) and Kang et al. (2024).

Table 1. Correlation Between Financial Literacy and Saving Behaviour.

Notes: **Correlation is significant at the 0.01 level (2-tailed).

FL: Financial literacy; SB: Saving behaviour.

Table 2. Correlation Between Financial Literacy and Entrepreneurial Intention.

Notes: **Correlation is significant at the 0.01 level (2-tailed).EI: Entrepreneurial intention; FL: Financial literacy.

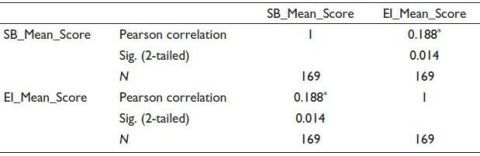

Table 3. Correlation Between Saving Behaviour and Entrepreneurial Intention.

Notes: *Correlation is significant at the 0.05 level (2-tailed).

EI: Entrepreneurial intention; SB: Saving behaviour.

Table 3 elucidates the correlation between saving behaviour and entrepreneurial intention. From the table, we infer that the correlation coefficient among the variables is 0.188, which is positive and statistically significant at the 0.05 level. This suggests a relatively weak relationship between saving behaviour and entrepreneurial intention. It leads to the implication that individuals who save more have a propensity to be more prone to express interest in starting a business, although the connection is not as strong as observed in the other two relationships. However, the result here contrasts with the results of Shrestha and Rawat (2023), Amofah et al. (2020), Bosumatari (2014), Erskine et al. (2006) and Rikwentishe et al. (2015).

Findings and Suggestions

This research study has exposed several significant findings and implications. First, it reveals a positive correlation between financial literacy and saving behaviour, which shows that people with better financial literacy tend to have better saving habits and vice versa. This suggests that imparting more financial literacy in instruction can help regulate saving behaviour, which is crucial for economic development. Policymakers could use financial literacy initiatives to encourage better saving habits, thereby contributing to the overall economic well-being.

Second, the research highlights a correlation between financial literacy and entrepreneurial intention, pointing towards the fact that individuals having better financial literacy are more inclined towards entrepreneurship. This underscores the need to increase financial literacy levels among the population to foster entrepreneurial intentions. By enhancing financial literacy, policymakers can potentially stimulate entrepreneurial activities, which are quintessential for economic growth and innovation.

Lastly, the study indicates a somewhat weak and statistically insignificant connection between saving behaviour and entrepreneurial intention. While saving behaviour may not strongly influence entrepreneurial intentions, the findings still emphasize the significance of promoting financial literacy. Improving financial literacy can indirectly impact both saving behaviour and entrepreneurial intentions, offering valuable opportunities for policymakers to enhance financial well-being and economic development.

Study Limitations and Scope for Future Research

While this research study offers valuable insights, it is important to acknowledge its challenges and limitations. First, the respondents in the sample do not include an equal number of males and females, which hinders the ability to conduct a comprehensive comparative analysis between these groups. Second, the size of the collected sample could be increased. However, due to the lack of time, more responses could not be collected. This could be further explored by future researchers through larger sample sizes or by examining different variables. Despite these limitations, the research undoubtedly contributes significantly to the knowledge of financial literacy, saving behaviour and entrepreneurial intentions by shedding light on their interrelationships.

Conclusion

This study successfully explored the synergy between financial literacy, saving behaviour and entrepreneurial intentions among individuals in the Tricity region. The findings indicate that financial literacy has a significant and positive impact on both saving behaviour and entrepreneurial intentions, confirming the essential role of financial awareness in promoting responsible financial actions and an entrepreneurial mindset. However, the correlation between saving behaviour and entrepreneurial intention, though positive, appeared to be weak.

The results emphasize the importance of strengthening financial education programmes and encouraging saving habits, especially among youth and aspiring entrepreneurs. These findings provide valuable insights for educators, financial institutions and policymakers to design strategies that foster entrepreneurship and financial responsibility, ultimately contributing to economic growth. Despite certain limitations, this study lays a foundation for further research with larger and more diverse samples and deeper exploration of other contributing variables.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Acs, Z. J., & Szerb, L. (2010). The global entrepreneurship and development index (GEDI): Measuring entrepreneurial performance. In Szerb L. & Acs Z. J. (Eds.), Entrepreneurship, economic growth and public policy (pp. 11–27). Springer. https://doi.org/10.1007/978-3-7908-2315-5_2

Afsar, J., Chaudhary, G. M., Iqbal, Z., & Aamir, M. (2018). Impact of financial literacy and parental socialization on the saving behaviour of university level students. Journal of Accounting and Finance in Emerging Economies, 4(2), 133–140. https://doi.org/10.26710/jafee.v4i2.526

Akanbi, S. T. (2016). Contributions of perfectionism and social support to the prediction of work–family conflict among women academics in Oyo State, Nigeria. Gender & Behaviour, 14(1), 7182–7196.

Aldi, B. E., Herdjiono, I., Maulany, G., Fitriani., (2019, September 24). The influence of financial literacy on entrepreneurial intention. In Proceedings of the 3rd International Conference on Accounting, Management and Economics 2018 (ICAME 2018). https://doi.org/10.2991/icame-18.2019.74

Ali, M., Ali, I., Badghish, S., & Soomro, Y. A. (2021). Determinants of financial empowerment among women in Saudi Arabia. Frontiers in Psychology, 12, Article 747255.

Ali, M. A. S., Ammer, M. A., & Elshaer, I. A. (2022). Determinants of investment awareness: A moderating structural equation modeling-based model in the Saudi Arabian context. Mathematics, 10(20), 3829. https://doi.org/10.3390/math10203829

Amofah, K., Saladrigues, R., & Akwaa-Sekyi, E. K. (2020). Entrepreneurial intentions among MBA students. Cogent Business & Management, 7(1), 1832401. https://doi.org/10.1080/23311975.2020.1832401

Anthen, W. L. (2004). Frozen in the headlights: The dynamics of women and money. Journal of Financial Planning, 13(9), 130–142.

Bilal, M., Fatima, S., Ishtiaq, M., & Azeem, H. S. M. (2020). Factors affecting the choice of Islamic banking by SMEs in Pakistan: Implications for Islamic banks’ corporate governance. International Journal of Islamic and Middle Eastern Finance and Management, 13(5), 865–882. https://doi.org/10.1108/IMEFM-07-2019-0304

Bilal, M. A., Khan, H. H., Irfan, M., Haq, S. M. N. U., Ali, M., Kakar, A., Ahmed, W., & Rauf, A. (2021). Influence of financial literacy and educational skills on entrepreneurial intent: Empirical evidence from young entrepreneurs of Pakistan. Journal of Asian Finance, Economics and Business, 8(1), 697–710. https://doi.org/10.13106/jafeb.2021.vol8.no1.697

Bosumatari, D. (2014). Determinants of saving and investment behaviour of tea plantation workers: An empirical analysis of four tea gardens of Udalguri District (Assam). PRAGATI: Journal of Indian Economy, 1(1), 144–164. https://doi.org/10.17492/pragati.v1i1.2497

Brown, P., Chappel, N., DaSilva Rosa, R., & Walter, T. (2006). The reach of the disposition effect: Large sample evidence across investor classes. International Review of Finance, 6(1–2), 43–78.

Browning, M., & Lusardi, A. (1996). Household saving: Micro theories and micro facts. Journal of Economic Literature, 34, 1797–1855.

Bruyat, C., & Julien, P.-A. (2001), Defining the field of research in entrepreneurship. Journal of Business Venturing, 16(2), 165–180.

Chen, H., & Volpe, R. P. (1998). An analysis of personal financial literacy among college students. Financial Services Review, 7(2), 107–128.

Cho, S. H. (2009). Role of saving goals in savings behaviour: Regulatory focus approach. [Doctoral dissertation, The Ohio State University].

Clark, R. L., & d’Ambrosio, M. B. (2008). Adjusting retirement goals and saving behavior: The role of financial education. In Lusardi A. (Ed.), Overcoming the saving slump: How to increase the effectiveness of financial education and saving programs (pp. 237–255). University of Chicago Press.

Domar, E. D. (1946). Capital expansion, rate of growth, and employment. Econometrica, 14(2), 137–147. https://doi.org/10.2307/1905364

Dunn, T., & Holtz-Eakin, D. (2000). Financial capital, human capital, and the transition to self-employment: Evidence from intergenerational links. Journal of Labor Economics, 18(2), 282–305. https://doi.org/10.1086/209959

Erskine, M., Kier, C., Leung, A., & Sproule, R. (2006). Peer crowds, work experience, and financial saving behaviour of young Canadians. Journal of Economic Psychology, 27(2), 262–284. https://doi.org/10.1016/j.joep.2005.05.005

Fuadi, I. F. (2009). Hubungan minat berwirausaha dengan prestasi praktik kerja industri siswa kelas XII Teknik Otomotif SMK Negri 1 Adiwerna Kabupaten Tegal. Jurnal PTM, 9, 92–98.

Garman, E. T., & Forgue, R. E. (2006). Personal finance (7th ed.). Houghton Mifflin Co.

Gnyawali, D. R., & Fogel, D. S. (1994). Environments for entrepreneurship development: Key dimensions and research implications. Entrepreneurship Theory and Practice, 18(4), 43–62. https://doi.org/10.1177/104225879401800403

Harahap, S., Thoyib, A., Sumiati, S., & Djazuli, A. (2022). The impact of financial literacy on retirement planning with serial mediation of financial risk tolerance and saving behavior: Evidence of medium entrepreneurs in Indonesia. International Journal of Financial Studies, 10(3), 66. https://doi.org/10.3390/ijfs10030066

Harrod, R. F. (1939). An essay in dynamic theory. The Economic Journal, 49(193), 14–33. https://doi.org/10.2307/2225181

Hermawan, A. (2005). Penelitian bisnis. PT Grasindo.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behaviour. Federal Reserve Bulletin. https://www.semanticscholar.org/paper/Household-financial-management%3A-the-connection-and-Hilgert-Hogarth/98275fc657276cdd49f6d383121cf8c3f73e3b8b

Huston, S. (2010). Measuring financial literacy. The Journal of Consumer Affairs, 44(2), 296–316.

Jamal, A. A. A., Kamal Ramlan, W., & Osman, Z. (2015). The effects of social influence and financial literacy on savings behaviour: A study on students of higher learning institutions in Kota Kinabalu, Sabah. International Journal of Business and Social Science, 6(11), 110–119.

Kang, G.-L., Park, C.-W., & Jang, S.-H. (2024). A study on the impact of financial literacy and digital capabilities on entrepreneurial intention: Mediating effect of entrepreneurship. Behavioural Sciences, 14(2), 121. https://doi.org/10.3390/bs14020121

Kilara, T., & Latortue, A. (2012, August 1). Emerging perspectives on youth savings. CGAP, 82, 1–16. https://www.cgap.org/sites/default/files/CGAP-Focus-Note-Emerging-Perspectives-on-Youth-Savings-Aug-2012.pdf

Koh, H. C. (1996). Testing hypotheses of entrepreneurial characteristics: A study of Hong Kong MBA students. Journal of Managerial Psychology, 11(3), 12–25. https://doi.org/10.1108/02683949610113566

Krueger, N. F., Reilly, M. D., & Carsrud, A. L. (2000). Competing models of entrepreneurial intentions. Journal of Business Venturing, 15(5–6), 411–432. https://doi.org/10.1016/S0883-9026(98)00033-0

Lee, J. M., & Hanna, S. D. (2015). Savings goals and saving behavior from a perspective of Maslow’s hierarchy of needs. Journal of Financial Counseling and Planning, 26(2), 129–147. https://doi.org/10.1891/1052-3073.26.2.129

Mahdzan, N. S., & Tabiani, S. (2013). The impact of financial literacy on individual saving: An exploratory study in the Malaysian context. Transformations in Business & Economics, 12(1), 41–55.

Mohamad Fazli, S., & MacDonald, M. (2010). Savings behaviour and financial problems among college students: The role of financial literacy in Malaysia. Cross-Cultural Communication, 6(3), 103–110.

Morrison, A., & Johnson, S. (2003). Entrepreneurship and regional economic development: The role of social capital. Regional Studies, 37(2), 139–156. https://doi.org/10.1080/0034340032000063937

Nasip, S., Amirul, S. R., Sondoh, S. L. Jr, & Tanakinjal, G. H. (2017). Psychological characteristics and entrepreneurial intention: A study among university students in North Borneo, Malaysia. Education + Training, 59(7/8), 825–840. https://doi.org/10.1108/ET-07-2016-0118

Ojogbo, L. U., Idemobi, E. I., & Ngige, C. D. (2022). Financial literacy and development of entrepreneurial intentions among graduates of selected tertiary institutions Nigeria. International Journal of Research Publication and Reviews, 3(7), 7421.

Organisation for Economic Co-operation and Development. (2019). Smarter financial education: Key lessons from behavioural insights for financial literacy initiatives. OECD Publishing. https://doi.org/10.1787/33d068c7-en

Rikwentishe, R., Pulka, B. M., & Msheliza, S. K. (2015b). The effects of saving and saving habits on entrepreneurship development. European Journal of Business and Management, 7, 111–118. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.735.9741&rep=rep1&type=pdf

Sabri, M. F., & MacDonald, M. (2010). Savings behaviour and financial problems among college students: The role of financial literacy in Malaysia. Cross-Cultural Communication, 6(3), 103–110.

Sadler-Smith, E. (2003). The role of intuitive expertise in entrepreneurship and management. Quorum Books.

Shrestha, P. M., & Rawat, D. S. (2023). Financial literacy, saving behaviour and entrepreneurial intention: The moderating effect of family financial socialization. Researcher CAB: A Journal for Research and Development, 2(1), 17–49. https://doi.org/10.3126/rcab.v2i1.57642

Song, Z., Mellon, G., & Shen, Z. (2020). Relationship between racial bias exposure, financial literacy, and entrepreneurial intention: An empirical investigation. JAMM: Journal of Artificial Intelligence and Machine Learning in Management, 4(1), 42–55. https://journals.sagescience.org/index.php/jamm/article/view/44.

Stolper, O. A., & Walter, A. (2017). Financial literacy, financial advice, and financial behaviour. Journal of Business Economics and Management, 87(5), 581–643.

Sulong, Z. (2017). Students’ perception towards financial literacy and saving behaviour. World Applied Sciences Journal, 35(10), 2194–2201. https://doi.org/10.5829/idosi.wasj.2017.2194.2201

Timmons, J. A. (1999). New venture creation: Entrepreneurship for the 21st century (5th ed.). Irwin/McGraw-Hill.

Warneryd, K. E. (1999). The psychology of saving: A study on economic psychology. Edward Elgar.

Zulaihati, S., Susanti, S., & Widyastuti, U. (2020). Teachers’ financial literacy: Does it impact on financial behaviour? Management Science Letters, 10(3), 653–658. https://doi.org/10.5267/j.msl.2019.9.014