1University Business School, Panjab University, Chandigarh, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Introduction: While the government aims to maximise its tax revenues to properly administer its affairs, companies try to minimise their tax liabilities through acceptable tax management and unacceptable tax evasion. Tax management among companies is a means of temporarily exaggerating earnings to defer financial distress. Consequently, companies’ tax-aggressive activities generate cash and increase liquidity. However, the reputational costs resulting from the companies’ engagement in aggressive tax planning also pose financial constraints for creditors.

Research Gap: Researchers have studied the relationship between financial distress and tax aggressiveness, but the results are mixed.

Objectives of the Study: This systematic literature review aims to analyse the existing literature on the relationship and suggest further research opportunities.

Research Methodology: This article analyses the existing literature using the PRISMA methodology, using 15 peer-reviewed articles from 13 leading journals published between 2015 and 2023.

Findings of the Study: The reviewed literature shows mixed results regarding the nexus of tax aggressiveness and financial distress. Some studies show that aggressive taxation practices are higher in firms facing financial distress, while others show a negative or insignificant impact. Studies also depict that firms involved in tax-aggressive activities often face a higher likelihood of bankruptcy.

Implication of the Study: Based on the results of this study, the relationship between tax aggressiveness with financial distress can be comprehended under different set-ups. Moreover, the study also identifies further research opportunities on the subject.

Tax aggressiveness, systematic literature review, tax avoidance, PRISMA

Introduction

Tax is the largest source of income for the government, and a major portion of it comes from direct taxes (Gober & Burns, 1997). Corporate tax is a direct tax that companies pay to the government against their profits, reducing their available distributed profit to the shareholders (Putri et al., 2017).

While the government aims to maximise its tax revenues for the proper administration of its affairs, companies try to minimise their tax liabilities through acceptable tax management as well as unacceptable tax evasion (Aliani et al., 2016). Companies adopt different techniques, such as investment in fixed assets, profit shifting to tax haven countries, base erosion, thin capitalisation, intellectual property structuring, capital structuring, etc., to reduce their tax liabilities. Acceptable tax management methods include tax planning and avoidance measures, which take advantage of loopholes in the tax legislation, whereas tax evasion is aggressive measures that violate taxation rules and are illegal in nature.

Various definitions of tax avoidance are provided in the literature. Hanlon and Heitzman (2022) defined tax avoidance as a continuum of strategies of tax planning that has legal tax management activities on one end and illegal tax evasive activities on either end. Malkawi and Haloush (2008) refer to tax evasion as financial manipulations as a means of tax sheltering. According to Dyreng et al. (2010), tax avoidance includes all transactions that result in a reduction in the tax liabilities of a company.

The academic literature is rich in studies that examine tax aggressiveness as the antecedent as well as the result of internal and external corporate phenomena. Duhoon and Singh (2023) illustrate four major predictors of tax saving behaviours, namely, tax knowledge (Bhalla et al., 2022), low effective tax rate (Cooper & Nguyen, 2020; Gober & Burns, 1997), higher debt financing (Fatica et al., 2013; Pramajaya et al., 2019) and higher investments in tax haven jurisdiction (Ngelo et al., 2022).

There has been an increasing focus of researchers on the determinants as well as consequences of tax avoidance in the last decade. Existing literature on the subject suggests that tax avoidance is more prevalent in companies in financial distress, based on the cost-benefit trade-off theory (Edwards et al., 2016) and the agency theory (Desai & Dharmapala, 2006). Research also shows that the tax aggressiveness level among firms affects their likelihood of default. The resource-based view suggests that tax-aggressive practices act as cash-generating activities and provide liquidity to the firm, making it less likely to default (Gabrielli & Greco, 2023; Hasan et al., 2017; Magerakis, 2022; Medioli et al., 2023). However, tax aggressiveness also taints the reputation of the firm, resulting in financial constraints and distress.

Despite the extensive research, aspects remain unclear regarding the precise mechanisms employing which tax aggressiveness influences financial distress and vice versa. The role of tax aggressiveness in alleviating financial distress under different economic conditions is still debated. Moreover, the extent to which these two variables act as moderating factors in each other’s outcomes, such as in capital structure decisions or firm performance, is not fully understood.

Financial distress is the firm’s inability to service its debt or other obligations, which can be due to challenges with cash flow and profitability, leading to either restructuring or bankruptcy (Andrade & Kaplan, 1998). The prediction of financial distress among companies before entering into insolvency or bankruptcy is of utility to various stakeholders of companies, including investors and the government. It helps companies implement strategic measures to avoid insolvency at times of financial vulnerability and other stakeholders to analyse the company’s performance more efficiently (Batista da Silva et al., 2023).

Based on the systematic review of the literature, this article aims to address the relationship between tax aggressiveness with financial distress. Analysing the methodology and findings of 15 peer-reviewed articles from 13 leading journals published between 2015 and 2023, this article gives insight into how financial distress impacts corporate tax aggressiveness, and tax aggressiveness impacts financial distress, and the moderating role of either variable on their determinants and consequences.

The remaining study has been organised as follows. The second section defines the keywords used for the study and describes the sample and research methodology used in the analysis. It also discussed the descriptive analysis of the sample. The third section lays out the results of the systematic analysis of shortlisted articles. The fourth section discusses the scope for future research based on the analysis. Finally, the fifth section concludes the study and discusses the contribution.

Research Methodology

Since tax aggressiveness has been defined differently by different authors, this study integrates terms used synonymously with tax aggressiveness, namely, tax avoidance, tax evasion, tax management and tax planning. Similarly, to include articles that use different definitions of financial distress, the terms bankruptcy and insolvency are also considered to synthesise an array of literature on the subject.

The potentially relevant literature was meticulously acquired by conducting a comprehensive search in the Scopus and Web of Sciences databases, which are most extensively used for peer-reviewed journals, following the Preferred Reporting Items for Systematic Review and Meta-Analysis (PRISMA) framework. To extract relevant studies from both databases, the Boolean search string used was: (‘Tax Aggressiv*’ or ‘Tax Avoid*’ or ‘Tax Evas*’ or ‘Tax Manag*’ or ‘Tax Plan*’) and (‘Bankrupt*’ or ‘Insolven*’ or ‘Distress*’) and (‘Corporat*’ or ‘Compan*’). The study only included peer-reviewed academic journal articles published in English. Peer-reviewed articles are considered for the study to focus on thorough, evidence-based research. Further, the subject area was limited to ‘Economics, Econometrics and Finance’ and ‘Business, Management and Accounting’ for the Scopus database and ‘Business Finance’, ‘Management’, ‘Business’ and ‘Economics’ for the Web of Sciences database. Further, the language was restricted to ‘English’ only. The refinement resulted in an initial sample of 26 articles on the Scopus database and 20 on the Web of Sciences database. After eliminating repeated articles, the initial sample totalled 37 articles.

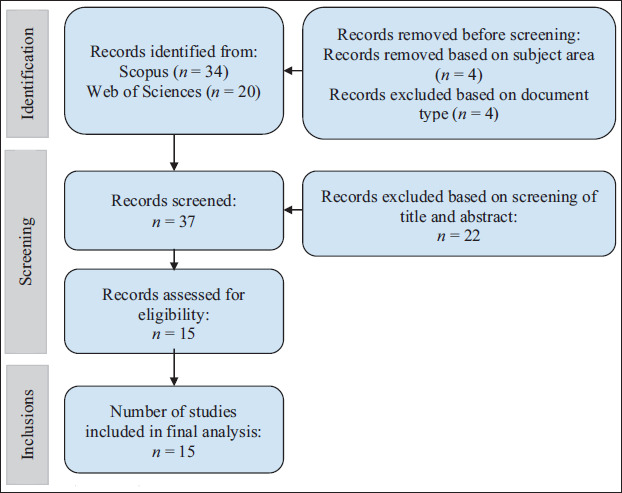

Figure 1. PRISMA Framework.

For the next screening step, the titles, abstracts and keywords of the articles were carefully reviewed. Articles that analysed tax aggressiveness and its relationship with financial distress or their moderating or moderating role on each other were included to give a final sample of 15 articles. Figure 1 represents the design of the study.

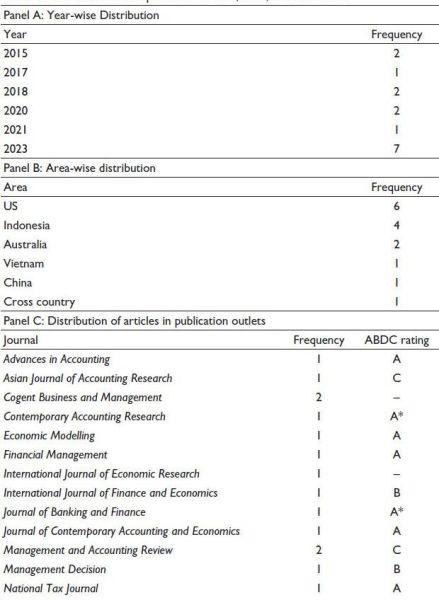

Analysis of the arrived sample shows that studies on the relationship between tax aggressiveness and financial distress have emerged only after 2015. An overview of the studies included in this review is presented in Table 1, depicting the year-wise frequency, the country-wise frequency and the journals in which these articles were published. Panel A of Table 1 shows a significant increase in research on the topic in the year 2023. Panel B of the tables shows that a majority of research is conducted in the US and Indonesia. Panel C shows that 11 out of the 13 journals in which the articles are published are ABDC journals, with nine journals belonging to the B category or above.

Results of Systematic Analysis

This part is divided into three sections. The first section elaborates on the existing literature on the impact of financial distress on tax aggressiveness among firms, the second section discusses the research on how tax aggressiveness impacts financial distress and the last section discusses the moderating role of financial distress on the relationship of aggressive tax practices with its antecedents.

Table 1. Distribution of Sample Based on Year, Area, and Publication.

Impact of Financial Distress on Tax Aggressiveness

Tax avoidance acts as a synergy-motivating tool for financially distressed firms having higher risk appetite by minimising tax expenses, allowing firms to garner higher profit margins and increase liquidity to finance using internal funds (Ariff et al., 2023). Managers of firms under distress have a higher incentive to employ strategies involving greater risks, particularly risk-shifting behaviour. Dictated by the cost-benefit trade-off theory, the costs of tax-aggressive activities in financially distressed firms are lesser than the potential benefits (Edward et al., 2013; Richardson, Taylor, et al., 2015). Moreover, the agency theory suggests that managers act in their self-interest rather than in the best interest of the shareholders during times of financial distress and engage in more tax-aggressive activities to overstate the income and increase associated compensation (Desai & Dharmapala, 2006).

Using a sample of 80 listed companies, Kamayanti et al. (2023) studied how corporate social responsibility, corporate governance and financial distress affect tax avoidance in Indonesia between 2016 and 2020 and found that firms facing distress have a higher degree of tax avoidance. Zhou et al. (2023) studied a sample of 51,205 firm-year observations from US-listed companies between 1988 and 2018 and found tax avoidance to be more pronounced in firms closer to financial distress and bankruptcy. These results are aligned with Dang and Tran (2021), who conducted a similar study between 2008 and 2020 using a sample of 369 Vietnamese-listed companies. On the contrary, Kalbuana et al. (2023) also studied the impact of CEO narcissism, corporate governance, company size and financial distress on tax avoidance using a sample of 29 Indonesian listed companies and found no relation of financial distress on the level of tax avoidance. These findings can be supplemented by Sun et al. (2023). Sun et al. (2023) examined the role of tax planning behaviour in mitigating a firm’s financial constraints in Chinese listed companies between 2010 and 2018 and found a positively significant association which was stronger for non-state-owned enterprises, big firms and non-political firms. However, the study also suggested that tax planning increased financial constraints in the long run.

Furthermore, Richardson, Lanis, et al. (2015) examined the impact of board independence and financial distress on tax aggressiveness using a sample of 753 listed companies in the US between 2006 and 2010 and found a positive relation, which was magnified during a global financial crisis. Richardson, Taylor, et al. (2015) also conducted a similar study in Australia using a sample of 203 listed companies in Australia and found similar results, signifying that during an external financial crisis, firms under distress are more tax-aggressive than those with sound finances. Ariff et al. (2023) carried out a cross-country examination on the association of financial distress with tax avoidance affected by the COVID-19 pandemic using a sample of 38,958 companies from 2015 to 2020 and found financially distressed firms to exhibit higher tax avoidance during the pandemic signalling that the pandemic enhanced the relationship. Kustono et al. (2023) also examined the impact of the pandemic on the causes of tax avoidance in the hospitality sector on the basis of political costs, monitoring mechanisms and financial decisions and found that firms facing financial distress exhibit a higher level of tax avoidance during the pandemic as well as non-pandemic times. These studies indicate that firms under distress adopt more tax-aggressive measures in the incidence of an external shock.

Impact of Tax Aggressiveness on Financial Distress

The impact tax aggressiveness has on financial distress faced by firms can be explained using the resource-based view, which dictates that tax-aggressive measures act as cash-generating activities that help firms avoid financial constraints and minimise the likelihood of facing financial distress. However, the reputational costs associated with engaging in tax-aggressive activities make the firms susceptible to scrutiny and resistance from creditors, resulting in lowered liquidity and a greater likelihood of facing distress.

Dhawan et al. (2020) studied the impact that tax aggressiveness and thin capitalisation have on bankruptcy risk in Australian firms between 2005 and 2016 and found that firms engaging in tax avoidance, along with thinly capitalised firms, faced higher bankruptcy risk. Bayar et al. (2018) additionally examined how corporate governance affects the relationship between tax avoidance and financial constraints using data from 35,000 US firms between 1990 and 2015 and found a negative relationship, which was higher for firms with weaker corporate governance.

Gabrielli and Greco (2023) also studied the impact of tax planning on the likelihood of financial default in different stages of the corporate life cycle among US firms between 1989 and 2016. They found tax planning firms to be less likely to default in the introduction and decline stages and more likely in the growth and maturity stages. On the contrary, Assagaf (2017) studied the relationship using data from seven Indonesian firms between 2014 and 2021 and found that tax aggressiveness had no significant impact on the financial distress faced by firms.

The Moderating Role of Financial Distress on the Antecedents of Tax Aggressiveness

Research reveals that financial distress moderates the impact of antecedents of tax aggressiveness. Kubich et al. (2020) studied the moderating role of financial distress on the relationship between CEO/CFO debt and tax avoidance using a sample of 4735 firm-year observations from US-listed companies from 2007 to 2012 and found that the positive relationship is magnified in firms with greater likelihood of default. Chen et al. (2018) also conducted a study using 29 broker mergers and 22 closures in the US between 1988 and 2008 to examine the moderating impact of financial distress in firms undergoing merger deals on tax avoidance and found that more financially constrained firms had a higher tax avoidance level.

Scope for Future Research

This study provides a thorough coverage of existing literature on the relationship between corporate tax aggressiveness and financial distress and highlights the scope for future researchers to study the extent further and the factors that affect the relationship. One of the most important concerns among academicians regarding conducting a study on corporate tax aggressiveness is related to its definition and measurement. With numerous definitions and measurement proxies available, operationalising based on suitability is a challenge. Dunbar et al. (2010) identify nine measures of tax aggressiveness employing effective tax rates and book-tax differences. Moreover, companies do not readily disclose their tax liability and avoidance strategies. Thus, the availability of data also poses a challenge. In the future, researchers can focus on comparing various proxies of tax aggressiveness in terms of its effectiveness as a determinant of financial distress.

Furthermore, there exists a need for longitudinal studies to examine the dynamic nature of the relationship over time. Moreover, the present literature is predominantly conducted on samples from the US, Indonesia and Australia. Research can be expanded by examining a sample from other developed and developing countries. Upcoming researchers can also focus on cross-country research to provide insight into how institutional differences influence this relationship along with the segmentation of developing and developed nations.

Conclusion

Tax aggressiveness, characterised by strategic manoeuvres to minimise tax liabilities, has become a focal point in contemporary corporate finance literature. Due to the risk associated with tax-aggressive activities, companies are often levied with higher costs of debt and lower credit ratings, indicating a likelihood of default. Additionally, the cash-generating nature of tax-aggressive activities often incentivises managers to indulge, to avoid financial constraints. Researchers have increasingly explored the relationship between tax aggressiveness and financial distress in the past decade.

The reviewed literature presents mixed observations regarding the relationship between tax aggressiveness with financial distress. Some studies exhibit that tax aggressiveness is higher in firms facing financial distress, supported by the cost-benefit trade-off theory and the agency theory, whereas other studies show a negative or no significant impact therein. Studies also indicate that firms involved in tax-aggressive activities often face a higher likelihood of bankruptcy. This can be justified by the reputational damage caused to these firms, which further poses financial constraints. Research also shows that tax aggressiveness has a negative impact on financial distress, which the resource-based view can explain.

Based on the investigation of existing literature, future researchers can explore the relationship by considering more facets that affect the relationship. Research can also be conducted to further study how the relationship is different for developing and developed countries.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

Aliani, K., Mhamid, I., & Rossi, M. (2016). Does CEO overconfidence influence tax planning? Evidence from Tunisian context. International Journal of Managerial and Financial Accounting, 8(3–4), 197–208.

Andrade, G., & Kaplan, S. N. (1998). How costly is financial (not economic) distress? Evidence from highly leveraged transactions that became distressed. The Journal of Finance, 53(5), 1443–1493.

Ariff, A., Wan Ismail, W. A., Kamarudin, K. A., & Mohd Suffian, M. T. (2023). Financial distress and tax avoidance: The moderating effect of the COVID-19 pandemic. Asian Journal of Accounting Research, 8(3), 279–292.

Assagaf, A. (2017). Subsidy government tax effect and management of financial distress state owned enterprises-case study sector of energy, mines and transportation. International Journal of Economic Research, 14(7), 331–346.

Batista da Silva, M. M., Ernani de Carvalho Junior, L., & Mendes Nascimento, E. (2023). The influence of tax practices on the probability of financial distress among B3 non-financial companies. Revista de Educação e Pesquisa em Contabilidade, 17(2), 161.

Bayar, O., Huseynov, F., & Sardarli, S. (2018). Corporate governance, tax avoidance, and financial constraints. Financial Management, 47(3), 651–677.

Bhalla, N., Kaur, I., & Sharma, R. K. (2022). Examining the effect of tax reform determinants, firms’ characteristics and demographic factors on the financial performance of small and micro enterprises. Sustainability, 14(14), 8270.

Chen, N. X., Chiu, P. C., & Shevlin, T. (2018). Do analysts matter for corporate tax planning? Evidence from a natural experiment. Contemporary Accounting Research, 35(2), 794–829.

Cooper, M., & Nguyen, Q. T. (2020). Multinational enterprises and corporate tax planning: A review of literature and suggestions for a future research agenda. International Business Review, 29(3), 101692.

Dang, V. C., & Tran, X. H. (2021). The impact of financial distress on tax avoidance: An empirical analysis of the Vietnamese listed companies. Cogent Business & Management, 8(1), 1953678.

Dhawan, A., Ma, L., & Kim, M. H. (2020). Effect of corporate tax avoidance activities on firm bankruptcy risk. Journal of Contemporary Accounting & Economics, 16(2), 100187.

Duhoon, A., & Singh, M. (2023). Corporate tax avoidance: A systematic literature review and future research directions. LBS Journal of Management & Research, 21(2), 197–217.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Edwards, A., Schwab, C., & Shevlin, T. (2016). Financial constraints and cash tax savings. The Accounting Review, 91(3), 859–881.

Fatica, S., Hemmelgarn, T., & Nicodème, G. (2013). The debt-equity tax bias: Consequences and solutions. Reflets et perspectives de la vie économique, 52(1), 5–18.

Gabrielli, A., & Greco, G. (2023). Tax planning and financial default: Role of corporate life cycle. Management Decision, 61(13), 321–355.

Gober, J. R., & Burns, J. O. (1997). The relationship between tax structures and economic indicators. Journal of International Accounting, Auditing and Taxation, 6(1), 1–24.

Hanlon, M., & Heitzman, S. (2022). Corporate debt and taxes. Annual Review of Financial Economics, 14, 509–534.

Hasan, I., Hoi, C. K., Wu, Q., & Zhang, H. (2017). Social capital and debt contracting: Evidence from bank loans and public bonds. Journal of Financial and Quantitative Analysis, 52(3), 1017–1047.

Kalbuana, N., Taqi, M., Uzliawati, L., & Ramdhani, D. (2023). CEO narcissism, corporate governance, financial distress, and company size on corporate tax avoidance. Cogent Business & Management, 10(1), 2167550.

Kamayanti, A., Qomariyah, N., Muwidha, M., & Ernawati, W. D. (2023). The significance of financial distress on tax avoidance compared to gender diversity and social responsibility: A study from Indonesia. Management & Accounting Review (MAR), 22(2), 401–419.

Kustono, A. S., Effendi, R., & Pratiwi, A. D. (2023). Political costs, monitoring mechanisms, and tax avoidance: Case of the hospitality industry. Management & Accounting Review, 22(2), 183–203..

Magerakis, E. (2022). Chief executive officer ability and cash holding decision. Review of Accounting and Finance, 21(5), 449–485.

Malkawi, B. H., & Haloush, H. A. (2008). The case of income tax evasion in Jordan: symptoms and solutions. Journal of Financial Crime, 15(3), 282–294.

Medioli, A., Azzali, S., & Mazza, T. (2023). High ownership concentration and income shifting in multinational groups. Management Research Review, 46(1), 82–99.

Ngelo, A. A., Permatasari, Y., Rasid, S. Z. A., Harymawan, I., & Ekasari, W. F. (2022). Ex-auditor CEOs and corporate social responsibility (CSR) disclosure: Evidence from a voluntary period of sustainability report in Indonesia. Sustainability, 14(18), 11418.

Pramajaya, J., Adam, P., Widiyanti, H. M., & Fuadah, D. L. L. (2019). The effect of debt equity ratio on tax planning before and after implementation of the minister of finance regulation number PMK-169/PMK. 010/2015 on registered companies on the Indonesia stock exchange. International Journal of Management and Humanities, 3(11), 25–31.

Putri, M. C. A., Zirman, Z., & Sofyan, A. (2017). Pengaruh Kompensasi Manajemen, Corporate Governance, Reputasi Auditor terhadap Manajemen Pajak (Studi Empiris pada Perusahaan Perbankan yang Terdaftar di Bei Tahun 2011–2014) [Doctoral dissertation, Riau University].

Richardson, G., Lanis, R., & Taylor, G. (2015). Financial distress, outside directors and corporate tax aggressiveness spanning the global financial crisis: An empirical analysis. Journal of Banking & Finance, 52, 112–129.

Richardson, G., Taylor, G., & Lanis, R. (2015). The impact of financial distress on corporate tax avoidance spanning the global financial crisis: Evidence from Australia. Economic Modelling, 44, 44–53.

Sun, J., Makosa, L., Yang, J., Yin, F., & Sitsha, L. (2023). Does corporate tax planning mitigate financial constraints? Evidence from China. International Journal of Finance & Economics, 28(1), 510–527.

Zhou, F., Shao, P., Xie, F., & Huang, J. (2023). The governance role of lender monitoring: Evidence from Borrowers’ tax planning. Advances in Accounting, 63, 100679.